Key Impact Points

- Greenwashing on the Rise: Incidents of greenwashing in the financial sector have tripled over the past five years, prompting increased regulatory scrutiny.

- Regulatory Challenges: Financial institutions face a dual challenge of avoiding greenwashing accusations while ensuring compliance with sustainability reporting regulations like the CSRD.

- Five Tips for Credibility: PwC expert Sophie de Vries provides actionable steps for financial institutions to enhance the credibility of their sustainability claims.

Overview

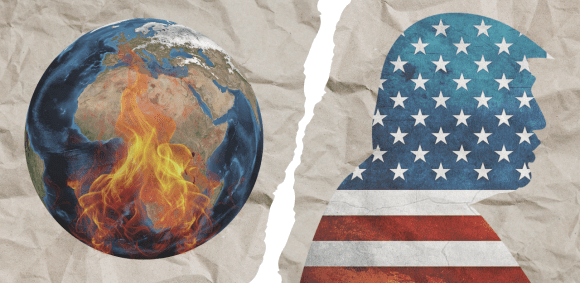

Greenwashing has surged in recent years, particularly in the financial sector, where incidents have tripled over the past five years. This trend has captured the attention of regulators, as well as national competition and market authorities, who are pushing for more credible sustainability claims from banks, insurers, and asset managers.

Sophie de Vries, PwC expert in sustainable finance, offers five key tips to increase credibility in sustainability reporting and avoid the legal risks associated with greenwashing.

Financial institutions are caught between a rock and a hard place. On the one hand, they must communicate their sustainability performance to satisfy customers and regulations. On the other hand, misleading claims can lead to accusations of greenwashing, reputational damage, and potential legal consequences.

The Complexity of Defining Greenwashing

The lack of a consistent definition of greenwashing complicates matters. According to the three European supervisory authorities (ESAs), greenwashing is defined as: “a practice whereby sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial services. This practice may be misleading to consumers, investors, or other market participants.”

In practice, greenwashing can occur when companies overemphasize the environmentally friendly aspects of their products while failing to disclose polluting characteristics or shifting their targets before achieving them.

Related Article: How to Ensure Your Green Promises Don’t Turn into Greenwashing

Legal and Reputational Risks

Legislation such as the Corporate Sustainability Reporting Directive (CSRD) and others is meant to provide a clearer framework for sustainability reporting, but it doesn’t guarantee accuracy. Without solid evidence, sustainability claims can expose financial institutions to significant reputational damage and legal action.

With complaints about greenwashing already having a legal basis in various national consumer laws and codes, new regulations like the Green Claims Directive (EU) and Sustainable Finance Disclosure Regulation (SFDR) are expected to lead to even more greenwashing claims in the coming years.

Sophie de Vries, partner in consulting at PwC Netherlands, emphasizes the importance of accurate and comprehensive sustainability reporting: “In the coming years, new sustainability legislation will lead to an increase in greenwashing claims. Therefore, companies must implement controls that ensure sustainability statements are accurate, transparent, and comprehensive.”

Change the World - Subscribe Now

Key Challenges for Financial Institutions

Financial institutions face several challenges when communicating about sustainability. These include the availability and quality of data, balancing diverse stakeholder interests, and navigating new reporting standards.

Challenge 1: Reliable Data

Currently, sustainability data is limited in both availability and quality. Financial institutions need reliable data, especially concerning scope 3 emissions, to back up their sustainability claims and avoid greenwashing risks. Although the CSRD encourages the use of benchmarks, these do not always provide the needed guarantees.

Challenge 2: Different Stakeholder Interests

Different visions of sustainability among stakeholders create another challenge. Meeting the diverse requirements and expectations of regulators, customers, and international stakeholders requires companies to develop a unified understanding of sustainability and greenwashing risks.

Challenge 3: Lack of a Clear Definition

Despite the efforts of European regulators, the lack of a universal definition of greenwashing continues to be an issue. Additionally, evolving legislation has left companies uncertain about who within their organization is responsible for managing greenwashing risks.

Five Tips to Increase the Credibility of Sustainability Claims

To address these challenges and increase the credibility of sustainability claims, PwC expert Sophie de Vries offers five practical tips:

1. Implement an Anti-Greenwashing Framework

Introduce a comprehensive anti-greenwashing framework to monitor where greenwashing risks exist within the organization. Ensure the framework covers relevant legislation, governance, products, and available data.

2. Train Your Employees

Equip employees with the knowledge and tools to understand sustainability issues and respond to dilemmas related to sustainability reporting.

3. Ensure Proper Data Management

Good ESG data management is critical. Be transparent about data sources, methodologies, and limitations to back up sustainability claims with reliable evidence.

4. Consider ESG-Related Legislation

Comply with existing and upcoming sustainability legislation to avoid potential legal risks associated with greenwashing claims.

5. Align Activities with Your Sustainability Strategy

Communicate honestly about how sustainability factors are connected to a product, portfolio, or activity. Ensure that marketing and sales align with your sustainability strategy to reduce the risk of unsubstantiated claims.

Conclusion

The rise in greenwashing claims and tighter regulations mean that financial institutions must ensure their sustainability reporting is credible and backed by robust data. While ambition in sustainability is essential, Sophie de Vries stresses that evidence of actual performance is the foundation for maintaining credibility in the financial sector.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn