- Mandatory reporting accelerates ESG integration: 95% of G250 companies now set carbon reduction targets, and 100% of U.S. companies report ESG metrics.

- Leadership is evolving: 56% of G250 companies have sustainability leaders, with 30% tying sustainability to executive compensation.

- Biodiversity and materiality on the rise: Reporting on biodiversity and double materiality continues to increase, aligning with EU’s CSRD standards.

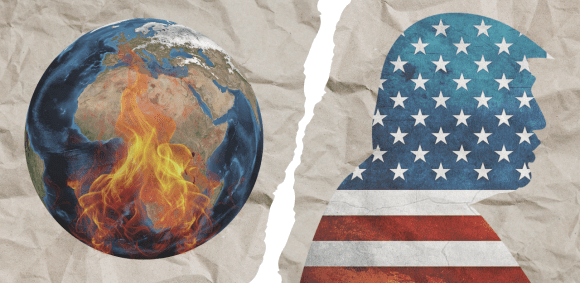

Mandatory ESG Reporting Gains Momentum

The 2024 edition of KPMG’s Survey of Sustainability Reporting reveals a seismic shift in how businesses approach sustainability. Companies worldwide are actively preparing for mandatory ESG reporting, spurred by evolving regulations such as the EU’s Corporate Sustainability Reporting Directive (CSRD).

KPMG’s survey shows a near-universal adoption of sustainability practices among the world’s largest 250 companies (G250), with 95% publishing carbon reduction targets, up from 80% in 2022. The U.S. market is leading the way, with every surveyed company reporting on ESG metrics.

Key Findings:

- 95% of G250 companies publish carbon targets, up from 80% in 2022.

- 56% of G250 companies employ sustainability leaders, compared to 45% in 2022.

- 30% of G250 companies link sustainability to executive compensation.

- 48% of U.S. companies conduct materiality assessments.

- Three-quarters of G250 companies use GRI standards.

- 69% of G250 companies and 54% of N100 companies obtain third-party assurance on their sustainability reporting.

Trends Driving the Transition

The report highlights six major trends reshaping ESG reporting:

- Sustainability reporting and carbon target setting are now standard practices.

- Companies are preemptively adopting mandatory CSRD reporting frameworks.

- Double materiality—required under CSRD—is already used by 50% of G250 companies.

- Voluntary standards like TCFD remain widely utilized as businesses prepare for mandatory frameworks.

- Biodiversity reporting has increased but lags behind carbon reporting.

- Adoption of TCFD recommendations continues to grow, paving the way for IFRS S2 standards.

Maura Hodge, KPMG US Sustainability Leader, emphasized “U.S. companies are demonstrating exceptional leadership in sustainability reporting despite regulatory uncertainty. By proactively adopting global standards and preparing for the EU’s CSRD, American businesses are positioning themselves at the forefront of ESG transparency.”

Future of ESG Reporting

With CSRD requirements kicking in by 2025, U.S. companies are set to expand their use of double materiality assessments, reflecting a shift toward comprehensive ESG reporting. This approach integrates environmental and social impacts with financial materiality, driving transparency across sectors.

John McCalla-Leacy, Head of Global ESG at KPMG International, added, “The increasing presence of sustainability leaders in boardrooms demonstrates solid progress toward greater corporate accountability. Today’s investors consider non-financial data as crucial as financial metrics in assessing long-term value.”

For further insights, read the full survey here.

Related Article: Innovation and Sustainability Go Hand in Hand: KPMG

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn