Key Impact Points:

- Exxon and Chevron explore gas plants with CO2 capture to meet data centers’ rising energy demands, independent of utility grids.

- Google, TPG, and Intersect Power are investing in industrial parks with gigawatts of co-located clean energy projects, launching by 2026.

- Texas sees rapid growth in microgrids driven by data centers and oilfield electrification, boosting energy resilience.

Data centers are increasingly defining the future of electricity use, with plans emerging for gas, renewables, and innovative infrastructure to handle skyrocketing demand. The energy mix powering artificial intelligence will shape CO2 emissions in the power sector.

Fossil Fuels Adapt to AI Demand

Exxon is advancing designs for a gas plant with CO2 capture to directly power data centers. Chevron is also developing behind-the-meter gas plants for similar purposes. Exxon CFO Kathy Mikell explained:

“Projects like this are fully detached from the grid. That means they’re independent of utility timelines, so they can be installed at a pace that other alternatives, including U.S. nuclear, just can’t match.”

GE Vernova has seen soaring orders for natural gas turbines, capable of powering cities, to meet data center demands.

Renewables Power Data Center Growth

Google, Intersect Power, and TPG Rise Climate Fund are collaborating to create industrial parks co-located with renewable energy plants. These projects, featuring renewables paired with storage, are set to debut in 2026. This partnership aligns with their commitment to scaling clean energy solutions.

Crusoe Energy closed a $600 million funding round to enhance its AI infrastructure, while Google and TPG announced an $800 million investment in Intersect Power, showcasing significant capital flows into data center energy solutions.

Change the World - Subscribe Now

Geothermal’s Potential Emerges

The International Energy Agency (IEA) finds that geothermal energy, despite currently supplying just 1% of global electricity, could fulfill 15% of global power demand growth by 2050 with technological advancements.

“Up to 80% of the investment required in a geothermal project involves capacity and skills that are common in the oil and gas industry,” the IEA notes.

Permitting and administrative barriers, however, delay projects by decades. With adequate support, geothermal costs could drop 80% by 2035, making it competitive with hydro and nuclear power.

Microgrids Gain Momentum in Texas

Texas is experiencing rapid adoption of microgrids, driven by the need for grid resilience amid extreme weather and rising energy demands. Data centers and oilfield electrification are key drivers.

The Dallas Fed reports microgrids are typically natural gas-powered but increasingly incorporate solar and storage. These self-sufficient systems provide critical flexibility and reliability for various industries.

Climate Finance and Emerging Technologies

Innovations in climate finance are also gaining traction. Enhanced rock weathering startup Terradot secured $58 million in seed and Series A funding, with backing from Google and Microsoft. This shows investor confidence in scalable carbon removal methods.

Rio Tinto is investing $2.5 billion in lithium production in Argentina, signaling optimism in the long-term demand for EV batteries. Meanwhile, the U.S. Energy Department’s $1.25 billion loan guarantee will support EVgo’s deployment of 7,500 charging units.

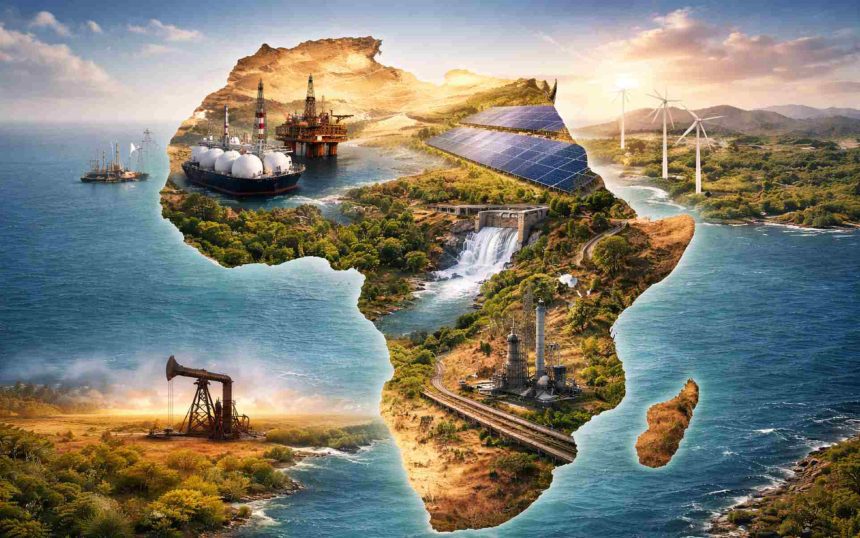

The evolving energy landscape demonstrates a balanced mix of fossil fuels, renewables, and emerging technologies like geothermal and microgrids. As data centers continue to expand, competition for innovative, sustainable energy solutions will shape the future of power infrastructure globally.

Related Article: 2024 Predictions for Cloud Sustainability & Green Data Centers

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn