Key Impact Points

- 60% of the world’s most exposed financial institutions still lack deforestation policies.

- Vanguard, BlackRock, and JPMorgan Chase provided over $1.6 trillion to high-risk companies in 2024.

- Financing to corporate laggards without deforestation commitments reached $864 billion.

Billions Flow to Forest-Risk Commodities

The 2025 Forest 500 – Finance report finds that the 150 financial institutions with the greatest exposure to deforestation risk channelled $8.9 trillion in 2024 to 500 companies linked to the production, processing, and trade of nine forest-risk commodities, including beef, palm oil, soy, and timber.

Despite holding significant leverage to influence supply chains, 60% of these institutions have no deforestation policy. “By funding forest risk companies without clear transition plans… financial institutions jeopardise their stability and economic returns,” the report warns.

Top Funders Named

Vanguard, BlackRock, and JPMorgan Chase together provided over $1.6 trillion to Forest 500 companies last year. Vanguard alone financed over $617 billion, including $149.2 billion to Amazon and $38.5 billion to Procter & Gamble, yet scored 0% in the ranking for lacking any public policies on deforestation, ecosystem conversion, or associated human rights abuses.

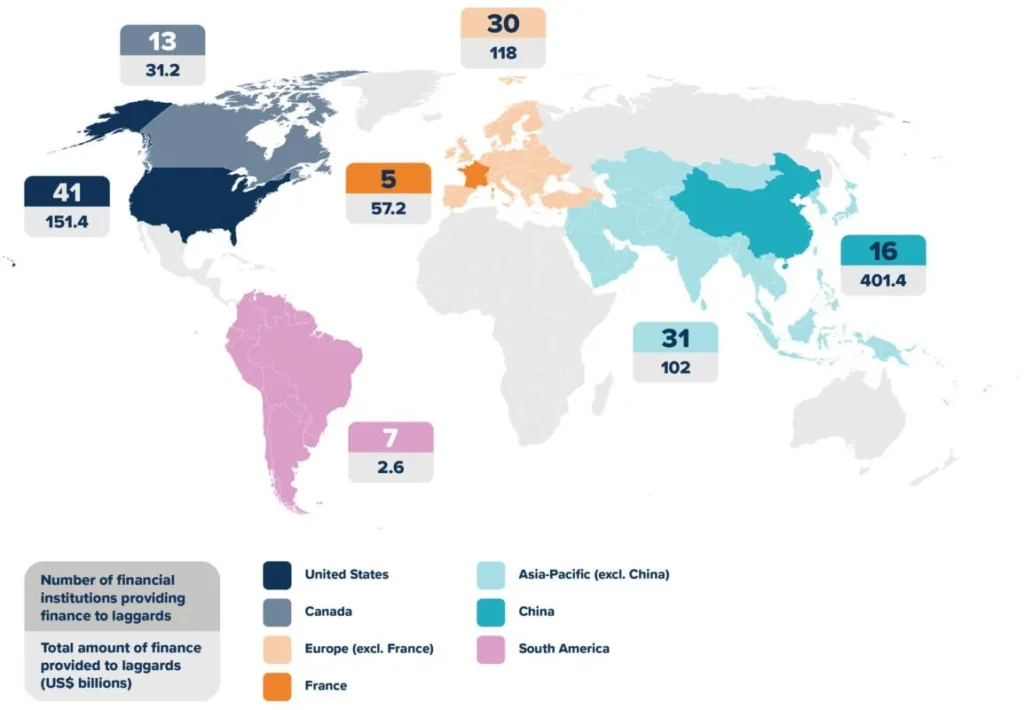

Institutions headquartered in China, the US, and France were the largest financiers of “corporate laggards” – companies with no public deforestation commitment. Chinese banks topped the list, providing $401 billion, followed by US institutions with $151 billion and French institutions with $57 billion.

Declining Policy Coverage

The share of assessed financial institutions with a public deforestation policy fell from 45% in 2023 to 40% in 2024, reversing a decade-long trend of policy adoption. Even where policies exist, implementation lags: only 27 institutions screen and monitor portfolios across all high-risk commodities, and just 17 have time-bound divestment threats.

The Forest 500 Finance Report calls deforestation “a solvable crisis” and urges all financial institutions to publish credible transition plans aligned with global 2030 goals. Transparent disclosure, robust screening, and active engagement with high-risk companies are cited as essential to halting forest loss and reducing related climate and financial risks.

Read the Forest 500 Finance Report

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn