In the crowded corridors outside the COP30 negotiation rooms, the most consequential document on climate finance is not a treaty text but a roadmap. Drafted jointly by the Azerbaijani COP29 presidency and the Brazilian COP30 presidency, the Baku to Belém roadmap attempts to answer the question left hanging in Baku: how to move from a formal goal of 300 billion dollars a year to at least 1.3 trillion dollars of climate finance for developing countries by 2035.

It is not a new fund, nor a negotiated outcome. Instead it is a political and technical map of where the money might realistically come from, who is expected to move first and which parts of the global financial system will have to change. For ministers of finance, MDB governors and central bankers, it functions less as a pledge and more as a working brief.

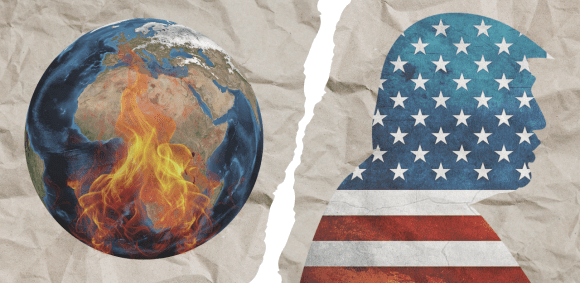

From Baku’s disappointment to a 1.3 trillion ambition

The roadmap is rooted in a compromise. In Baku, developing countries had pushed for a post 2025 climate finance goal that reflected their full needs. The result was a formal target of at least 300 billion dollars a year by 2035 and a weaker call for all actors to scale up finance to at least 1.3 trillion dollars a year by the same date.

That higher figure echoes proposals from African negotiators and analysis by the Independent High Level Expert Group on Climate Finance. It reflects the scale of investment needed if developing countries are to implement their nationally determined contributions and adaptation plans without driving debt to unsustainable levels. Yet the language that created it was deliberately soft. The 1.3 trillion is a “call on” all actors, not a binding obligation on any specific group.

Against a backdrop of cuts to aid budgets in major donor countries and a more expensive cost of capital for emerging markets, the presidencies were asked to turn that aspirational number into something more concrete. The Baku to Belém roadmap is their attempt to do that without reopening the formal negotiations on the new collective quantified goal.

Five “R”s to unlock capital

At its core, the roadmap is organised around five action fronts: replenishing, rebalancing, rechanneling, revamping and reshaping. Together they are meant to show how public and private flows could be expanded and redirected towards the 1.3 trillion ambition.

Replenishing covers grants, concessional finance and low cost capital. It assumes a much larger role for multilateral climate funds and MDBs, and calls for developed countries to deliver “manyfold” increases in grants and concessional flows, both bilateral and multilateral. It also stresses that access and simplicity matter as much as volume.

Rebalancing focuses on fiscal space and debt sustainability. External debt service for developing countries has more than doubled since 2014 to 1.7 trillion dollars a year, with net interest payments reaching 921 billion dollars in 2024. Many borrowers face borrowing costs two to four times higher than those of developed countries. The roadmap points to climate resilient debt clauses, debt for climate swaps and restructuring as part of the solution and floats the idea of a one stop shop, bringing together MDBs, the IMF and UN bodies to support debtor countries.

Rechanneling is about private finance and the cost of capital. The mobilisation of private flows through official interventions reached 46 billion dollars in recent years and has grown, but remains small compared with needs. The roadmap looks to blended finance, guarantees, foreign exchange hedging and securitisation platforms as ways to expand the pipeline, while recognising concerns that private investors will not fund loss and damage or many adaptation projects at acceptable terms.

Revamping refers to capacity and coordination. It argues that national investment strategies, project preparation, whole of government approaches and country platforms are needed to turn NDCs and NAPs into coherent portfolios that investors and funders can respond to.

Reshaping deals with the rules of the game. It looks to prudential regulation, interoperable taxonomies, disclosure standards, more nuanced credit rating methodologies and climate stress testing as levers to shift capital flows towards developing countries at scale.

Across these fronts the roadmap also identifies thematic priorities: adaptation and loss and damage, clean energy access and transitions, nature and its guardians, agriculture and food systems, and just transitions. The message is that how and where capital flows matters as much as how much is raised.

Who pays, what counts and where the money comes from

Behind the structure sit familiar political disagreements. Submissions from developing country groups emphasise Article 9.1 of the Paris Agreement and insist that developed countries remain the primary source of public climate finance, over and above the 300 billion goal. Some, like the Like Minded Developing Countries, argue that this provision must be the central pillar of the roadmap.

Many developed countries, by contrast, stress the need to “broaden” climate finance. In practice that means greater reliance on private capital and new global levies, including taxes on aviation and shipping, wealth and corporate profits, financial transactions and luxury or military goods. The roadmap catalogues these ideas, with indicative revenue ranges that run into the hundreds of billions. It also highlights the potential of rechannelled special drawing rights and carbon pricing.

There are also disagreements over what should count as climate finance. Some small island states oppose counting support for fossil related projects, while others, including the Arab Group, resist “exclusionary criteria”. China argues that purely commercial flows should not be counted towards the 1.3 trillion, which in its view should include only investment mobilised by public interventions.

The document itself remains cautious. The language attached to most proposed actions is voluntary, using formulations such as “could consider” and “could adopt”. The roadmap does not assign quantitative obligations to any group of contributors, nor does it reopen legal debates about differentiated responsibility. Instead it is offered as a reference framework that others may choose to use.

Baku to Belém Roadmap: Key Actions and Timelines

| Who | What | When |

|---|---|---|

| COP29 and COP30 presidencies | Convene an expert group to develop “concrete financing pathways” | October 2026 |

| COP29 and COP30 presidencies | Convene dialogue sessions with parties and stakeholders | 2026 |

| Developed countries | Creating a delivery plan to set out intended contributions and pathways for NCQG targets | End of 2026 |

| Parties to the Paris Agreement | Request the Standing Committee on Finance to provide an aggregate view on pathways for NCQG | 2027 |

| Governments | Request UN entities to examine and review collaboration options | October 2026 |

| Multilateral climate funds | Report annually on the implementation of their “operational framework” on complementarity and coherence, to enhance cross-fund collaboration | Annually |

| Multilateral climate funds | Develop monitoring and reporting frameworks and coordination plans, explaining their operations by region, topic and sector | October 2027 |

| Multilateral development banks | Collective report on achieving a new aspirational climate finance target for 2035 | October 2027 |

| Multilateral development banks | Adopt “explicit, ambitious and transparent targets for adaptation and private capital mobilisation” | October 2027 |

| International Monetary Fund | Conduct an assessment of the costs, benefits and feasibility of a new issuance of “special drawing rights” | October 2027 |

| UN regional economic commissions | Develop a study on the potential for expanding debt-for-climate, debt-for-nature and sustainability-linked finance | End of 2027 |

| UNSG-convened working group | Propose a consolidated set of voluntary principles on responsible sovereign borrowing and lending | October 2026 |

| Credit rating agencies | Develop a structured dialogue platform with ministries of finance to make progress on refinements to credit rating methodologies | October 2027 |

| Philanthropies | Expand funding of knowledge hubs | October 2026 |

| UN treaty executive secretariats | Develop a joint report with proposals on economic instruments to support co-benefits and efficiencies | End of 2027 |

| Insurance Development Forum and the V20 | Establish a plan for achieving cheaper and more robust insurance and pre-arranged finance mechanisms for climate disasters | October 2026 |

| Financial Stability Board, the Basel Committee on Banking Supervision and the International Association of Insurance Supervisors | Conduct a joint assessment of whether and how barriers to investment in developing countries could be reduced | October 2027 |

| World’s 100 largest companies | Report annually on how they are contributing towards the implementation of NDCs and NAPs | Annually |

| World’s 100 largest institutional investors | Report annually on how they are contributing towards the implementation of NDCs and NAPs | Annually |

What happens next and why it matters for decision makers

The Baku to Belém roadmap is not part of the formal COP30 negotiating agenda but it will underpin many of the summit’s finance discussions. It proposes that the COP29 and COP30 presidencies convene an expert group to turn the five action fronts into concrete financing pathways, with a first report due in late 2026. It suggests that developed countries could work up a joint delivery plan for how they intend to meet the 300 billion goal and that MDBs, the IMF, credit rating agencies and major investors should set out their own targets and methodologies over the next two to three years.

For ministries of finance, central banks and MDB boards, the roadmap matters because it crystallises expectations. It signals that future scrutiny will focus on how much concessional finance is truly additional, how quickly debt burdens can be managed down, how effectively public money is de risking private flows and whether regulatory reforms are easing or reinforcing barriers to investment in developing countries.

Whether the Baku to Belém roadmap remains another “billions to trillions” slogan or evolves into a practical blueprint for fiscal and financial reform will depend less on new communiqués in Belém and more on the choices finance and economic policymakers make over the rest of this decade.

RELATED STORIES:

- Sustainable Ocean Economy Could Generate 51 Million Jobs by 2050, Ocean Panel Finds

- Panama Opens 20-Day Public Consultation on Draft Climate Change Framework Law

- Australia Unveils Sustainable Finance Roadmap to Lead in Global Sustainability Efforts

- Bridging the ESG Gap in the Middle East: Aligning Corporate Initiatives with Employee Priorities

- Show us the Money: Finance Central at COP29

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn