BlackRock’s Global Infrastructure Partners (GIP) has agreed to invest up to $335 million in Aditya Birla Renewables, marking one of the largest foreign commitments to an Indian clean energy platform as the country races toward its 2030 climate and power sector goals. The transaction, which begins with a $225 million minority stake purchase and includes an option for an additional $110 million, values the Aditya Birla Group subsidiary at roughly $1.6 billion and underscores rising global investor confidence in India’s renewable energy expansion.

India’s Expanding Role in Global Clean Energy Markets

The investment comes as India accelerates efforts to reshape its power system. The country plans to install 500 GW of renewable capacity by 2030, reduce emissions intensity by 45 percent and generate approximately half of its electricity from non-fossil sources. Against that backdrop, Aditya Birla Renewables (ABREN) has emerged as a fast-scaling national platform, expanding its portfolio to 4.3 GW across solar, floating solar, hybrid, wind, storage and emerging technologies such as green hydrogen and green ammonia.

Aditya Birla Group Chairman Kumar Mangalam Birla said the deal will support ABREN’s growth beyond 10 GW, adding: “India stands at the cusp of an energy transformation, arguably one of the largest anywhere in the world. The scale of the renewables opportunity in India is extraordinary, driven both by the urgent imperative of decarbonisation, and the sheer arithmetic of demand. This business sits squarely at the intersection of national energy security and climate leadership, two defining priorities for the coming decades.”

Global Capital Flows Converge With India’s Climate Ambition

The deal reflects a broader pattern of global investors treating India as a central hub for clean energy deployment and industrial decarbonization. For GIP, now operating under BlackRock after a $12.5 billion acquisition in 2024, the investment fits into a strategy emphasizing long-term opportunities in energy transition, energy security and infrastructure modernization.

Raj Rao, GIP’s President and COO, said the partnership aims to position ABREN as a leading renewable platform supporting industrial decarbonization: “GIP’s experience in infrastructure across the globe, combined with Aditya Birla’s technical, operational and industrial capabilities, aims to develop Aditya Birla Renewables into a leading renewable platform that can contribute to the Indian industry’s decarbonization objective. Our investment reflects GIP’s confidence in India’s renewables sector and our commitment to advancing the energy transition in India.”

Strengthening India’s Renewable Infrastructure Base

The ABREN investment is a signal of how global capital is moving to meet India’s rising power demand, much of which is expected to be supplied by utility-scale solar, wind and hybrid systems. The company’s diversification into storage, green hydrogen and green ammonia reflects expanding opportunities in India’s hard-to-abate sectors, where industrial firms are increasingly seeking clean power procurement and electrification pathways.

By lifting ABREN’s capacity trajectory from 4.3 GW toward the 10-GW threshold, the stake purchase aligns with India’s need for large-scale private-sector deployment to meet its 2030 objectives. It also provides a template for how foreign institutional investors can collaborate with major domestic industrial groups to expand clean energy infrastructure at speed.

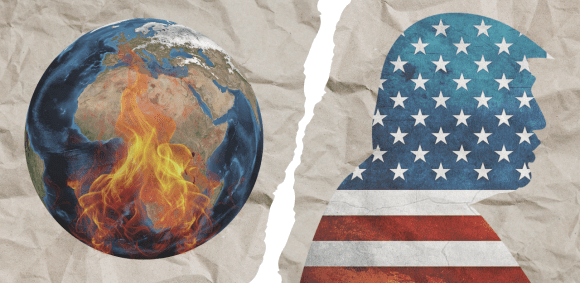

A Deal With Implications Beyond India’s Borders

India’s clean energy growth is shaping regional energy security dynamics and attracting international interest in supply chain development, particularly around green hydrogen, ammonia and renewable power equipment. The partnership between Aditya Birla Group and BlackRock’s GIP illustrates how cross-border capital and domestic industrial expertise are converging to advance decarbonization in emerging economies.

The transaction also contributes to a wider reconfiguration of global climate finance flows, with institutional investors increasingly looking beyond Europe and North America to markets where renewable demand growth is highest. As other countries refine their national transition strategies, India’s model — pairing industrial capacity with foreign capital — may offer a replicable approach.

RELATED STORIES:

- Microsoft Roots Its Largest APAC Carbon Deal in India’s Panna Forest

- TotalEnergies takes action to give access to clean cooking to 100 Million people in Africa and India

- Sewing Change: Saheli Women’s Empowerment Through Sustainable Fashion at the UN SDG Media Zone

- Carbon Capture vs. Renewables: The True Cost of Cutting Emissions

- The Power Players of COP30 and the Future They’re Negotiating

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn