Key Impact Points:

- CSA halts development of mandatory climate disclosure and diversity reform to address global market shifts.

- CSSB’s new sustainability standards remain voluntary, encouraged for issuer guidance.

- Critics warn the delay leaves investors less informed and businesses unprepared.

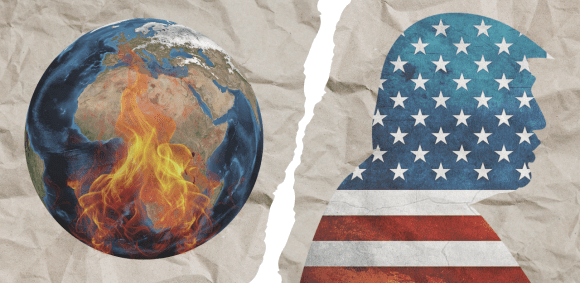

CSA Pauses Key Sustainability Disclosure Rules Amid Global Shifts

The Canadian Securities Administrators (CSA) has announced a pause on developing new mandatory climate-related and diversity-related disclosure rules. The decision aims to help Canadian markets adjust to evolving global regulatory landscapes, including developments in the U.S. and EU.

“In recent months, the global economic and geopolitical landscape has rapidly and significantly changed, resulting in increased uncertainty and rising competitiveness concerns for Canadian issuers,” said Stan Magidson, Chair of the CSA and Chair and CEO of the Alberta Securities Commission. “In response, the CSA is focusing on initiatives to make Canadian markets more competitive, efficient and resilient.”

CSSB Standards Remain Voluntary for Now

While suspending rulemaking, the CSA pointed to the Canadian Sustainability Standards Board (CSSB)’s newly released voluntary sustainability standards as a resource. These align with global norms, notably those of the International Sustainability Standards Board (ISSB), and offer guidance for issuers preparing climate-related disclosures.

“The CSSB standards provide a useful voluntary disclosure framework for sustainability and climate-related disclosure,” the CSA said.

Incoming CSSB Chair Wendy Berman emphasized, “We recognize that regulatory approaches may evolve in response to market conditions, but the demand for credible, comparable sustainability information continues to grow – both globally and at home.”

Diversity Disclosure Status Quo Maintained

On diversity, the CSA confirmed that non-venture issuers must continue disclosing the representation of women on boards and in executive roles under current requirements in National Instrument 58-101.

The CSA added it will continue overseeing issuer disclosure practices, flagging risks like misleading claims and greenwashing. Future changes to the paused projects will be communicated with sufficient notice.

Pushback from Environmental Advocates

Environmental groups reacted strongly to the CSA’s move, warning that delaying regulation undermines market readiness and investor transparency.

Julie Segal, Senior Manager of Climate Finance at Environmental Defence Canada, stated:

“The CSA is being regressive. Postponing requirements for businesses to get prepared for climate change and align with positive climate action will only leave businesses less prepared, investors less informed, and Canada’s economy less competitive.”

Despite the pause, the CSA reaffirmed its intent to revisit both climate and diversity-related disclosure projects “in future years” while continuing to monitor both domestic and international regulatory trends.

Related Article: Climate Disclosure Pushes Ahead: Chevron Down, ESG Pushback Ignored

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn