Key Impact Points:

- China led Q1 2025 with $20.7B in green bond issuance, outpacing Germany and the U.S.

- U.S. issuers are backing away from green labels amid political pushback under Trump.

- China is expanding policy tools, including a new green sovereign bond framework and taxonomies.

China Poised to Lead Green Bond Market in 2025

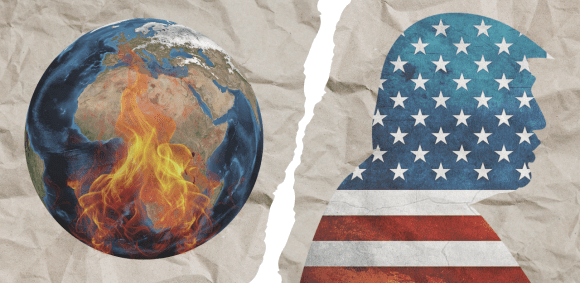

China is on track to become the world’s top green bond issuer this year, amid a decline in U.S. issuance driven by political climate hostility, according to the Climate Bonds Initiative.

“China will definitely be the world’s largest green bond market this year,” said Sean Kidney, CEO of Climate Bonds.

In Q1 2025, China issued $20.7 billion in green bonds, surpassing Germany’s $17.4 billion and the U.S.’s $14.1 billion. Although the U.S. still leads cumulatively since 2006, that gap is closing fast.

U.S. Issuers Retreat Amid Climate Backlash

U.S. green bond issuance is slowing as companies avoid labeling their debt “green” to escape political scrutiny.

“I don’t expect a lot of US corporate green bond issuance in the near future,” Kidney said. “In the US ‘drill, baby, drill’ is the new mantra.”

Under President Donald Trump’s second administration, the U.S. has declared a national energy emergency and reversed several climate policies, leading companies to distance themselves from ESG branding.

China Ramps Up Green Finance Policy

In contrast, China is expanding its green finance infrastructure. It recently launched its first-ever sovereign green bond ($824 million), listed in yuan on the London Stock Exchange. The move followed the Ministry of Finance’s publication of a Green Sovereign Bond Framework for overseas issuance.

The framework will direct proceeds toward climate mitigation and adaptation, biodiversity, pollution control, and resource protection.

China is also introducing two new taxonomies: one focused on transition finance and another on climate resilience—tools designed to scale private capital toward climate-positive investments.

A Global Shift

Although the U.S. led green bond issuance in 2024 with $84.7 billion, China is now gaining ground. It surpassed U.S. issuance in both 2022 and 2023, and Climate Bonds expects 2025 to continue that trend if current momentum holds.

Kidney emphasized that China’s policy-driven push stands in stark contrast to the U.S. retrenchment.

“China is rolling out a transition finance taxonomy, and a resilience taxonomy to channel private finance towards activities that create resilience against climate change.”

Related Content: China’s Green Leap Forward

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn