Small and medium-sized enterprises (SMEs) are the backbone of the global economy — but they remain one of the most underfunded segments in the race to net zero. A new report by the International Chamber of Commerce (ICC) and Sage, released ahead of COP30, warns that without targeted reforms in climate finance, digital innovation, and policy support, SMEs risk being left behind in the green transition.

A widening gap between ambition and access

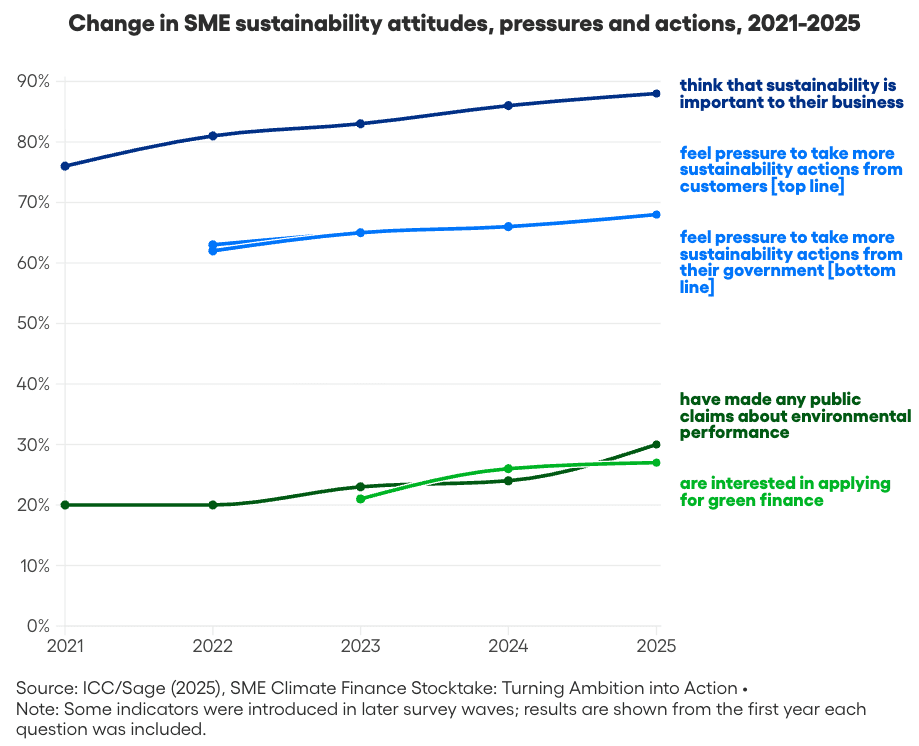

The “SME Climate Finance Stocktake: Turning Ambition into Action” surveyed 8,250 SMEs across 17 markets, along with banks, investors, and policymakers. It found that while small businesses increasingly recognize their role in advancing climate goals, most lack the capital to act.

A small group of medium-sized firms — particularly in manufacturing and transport — are leading on sustainability investments, yet they represent only a fraction of the broader SME landscape. The report highlights a “clear divide between ambition and action,” as many businesses eager to decarbonize remain locked out of financing due to complex reporting requirements, high transaction costs, and inconsistent data frameworks.

Financial institutions respond — but scale remains limited

Across markets, banks and development finance institutions are expanding lending programs and sustainability-linked products for smaller firms. Blended finance tools — combining concessional and private capital — are also gaining traction to lower risk for lenders and investors.

However, the ICC and Sage caution that current efforts are “insufficient to match the scale of SME demand or the urgency of the global climate transition.” With SMEs representing over 90% of global businesses and more than 50% of employment worldwide, their inclusion in the sustainable finance ecosystem is essential to achieving the Paris Agreement and Sustainable Development Goals.

Digital tools and AI as accelerators

The SME Climate Finance Stocktake Report underscores the potential of digitalization and artificial intelligence (AI) to bridge the financing gap. SMEs using digital sustainability tools are:

- 2.4 times more likely to have formal reporting systems

- 1.6 times more likely to apply for green finance

- 71% report reduced environmental impacts

- 78% expect a competitive advantage within five years

Emerging innovations are already transforming how small businesses demonstrate sustainability performance. These include automated emissions calculators, AI-driven loan applications that draw directly on accounting data, shared SME data hubs supported by development banks, and machine-learning systems capable of pre-filling sustainability templates.

According to the ICC, such tools can dramatically reduce compliance burdens and unlock new lending opportunities — particularly in developing markets where reporting capacity is low.

Five urgent actions to turn ambition into action

To ensure SMEs can participate meaningfully in the global climate transition, the ICC–Sage report calls for five coordinated policy and market responses:

- Simplify and harmonize reporting standards to make sustainability disclosures user-friendly for small businesses.

- Create enabling ecosystems through fiscal incentives, capacity-building, and shared tools for SME reporting.

- Harness AI and digital innovation via partnerships between governments and technology firms.

- Standardize data requests and promote peer learning across financial institutions and large corporates.

- Expand sustainability-linked products and technical assistance, especially for SMEs in emerging economies.

The ICC describes COP30 in Belém, Brazil, as a pivotal moment for translating these recommendations into global policy commitments.

Towards inclusive green finance

For policymakers, the message is clear: achieving global climate goals depends on mobilizing millions of small firms that collectively drive innovation, employment, and supply chains. Yet without access to finance and digital tools, their contribution will remain constrained.

As John W.H. Denton AO, Secretary General of the ICC, recently emphasized in related remarks, “SMEs are not the periphery of the climate transition — they are its foundation. The task now is to ensure they can access the capital and tools to lead it.”

See related coverage: Green Climate Fund results-based payments in Africa

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn