Shaping Sustainability and Climate Investing in 2024

Key Insights

As we move into 2024, sustainability and climate investing are influenced by significant trends. Extreme weather events are becoming commonplace, prompting economic and social changes. Technological advances in AI are reshaping data privacy concerns, and investments in nature through the voluntary carbon market, particularly through biodiversity investing, are gaining traction.

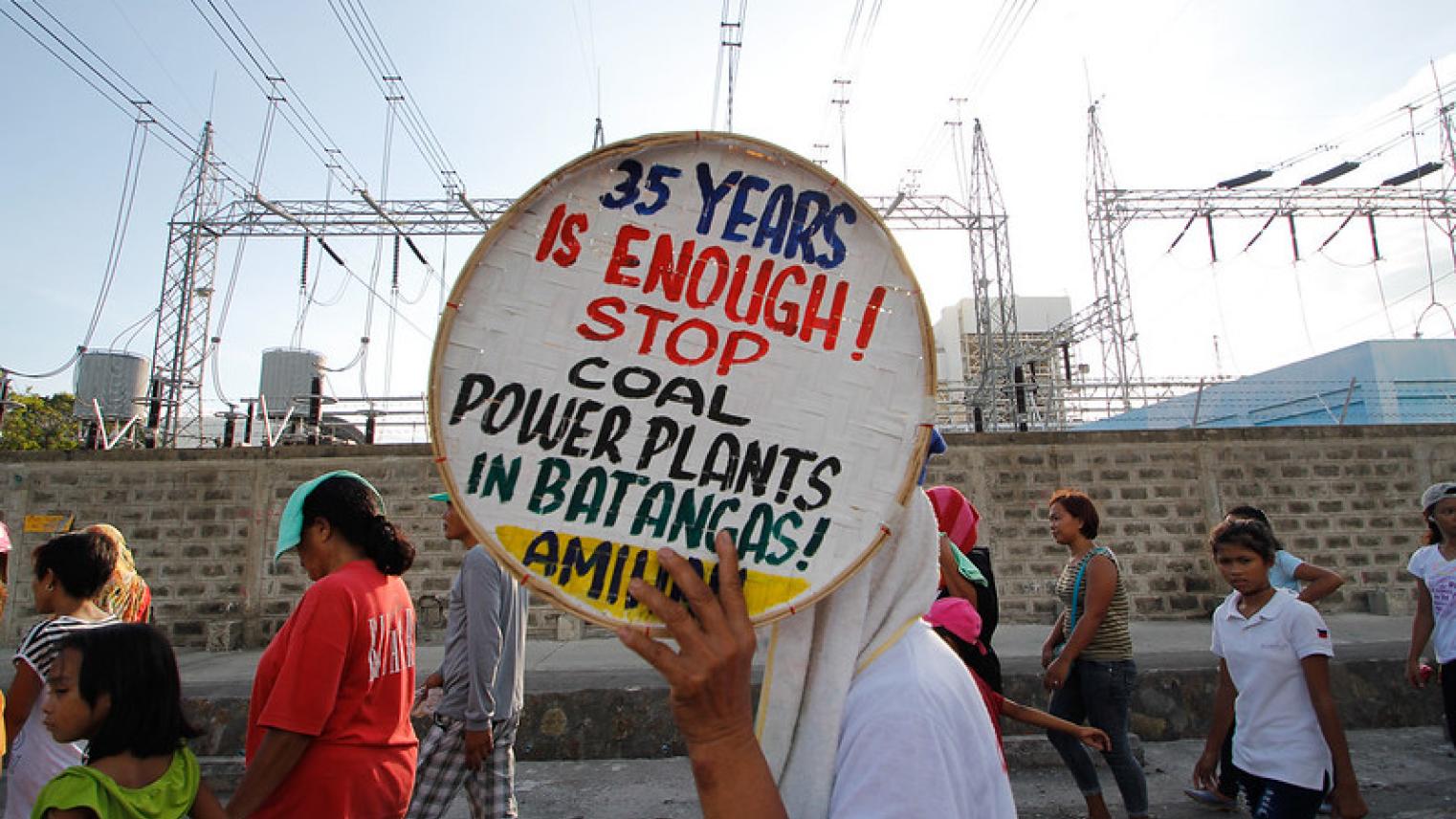

Extreme Weather’s Impact on Workplaces

Recent summers have seen unprecedented heatwaves, affecting worker productivity and sparking labor disputes at companies like UPS and Amazon. Higher wet-bulb globe temperatures (WBGTs), which measure heat and humidity, pose health risks and reduce productivity, especially in non-temperature-controlled environments. By 2050, increased CO2 emissions could severely impact productivity in sectors such as logistics, manufacturing, and mining, necessitating new measures to manage workforce risks.

Labor-management risk exposure for the 10 most heat-vulnerable economic activities

Analysis covers constituents of the MSCI ACWI Index, categorized using NACE (European classification of economic activities) section codes, with the 10 most heat-vulnerable economic activities included in the chart. Our assessment of the vulnerability of each activity is based on the productivity loss at a WBGT of 22ºC, looking at physical activity and prevalence of air conditioning — a higher value implies a higher vulnerability. Our assessment of exposure to traditional labor-management-related risks includes elements such as revenue per employee, workforce size, geographical location and a history of unrest, with a higher score implying a higher exposure to productivity-related risks.

Data as of October 2023. Source: MSCI ESG Research

AI and Data Privacy

Generative AI models, while transformative, raise significant data privacy concerns. Applications like search tools and image renderers collect vast amounts of personal data, often without clear consent. Policymakers, especially in the EU, are responding with regulations like the General Data Protection Regulation (GDPR). These measures emphasize user rights and consent, crucial for the ethical development of AI. Companies involved in AI development must integrate robust privacy protections to align with evolving regulations.

Companies across the AI value chain may need better guardrails and privacy provisions

Universe of analysis: 83 companies with three or more patents in areas related to “generative AI” (Google Patent search terms: generative AI, large language model, deep learning and neutral networks) that were constituents of the MSCI ACWI Index, as of Sept. 25, 2023. Companies were then grouped into two camps: 1) those involved in both AI foundation-model training and development of applications, such as companies in semiconductors and semiconductor equipment, interactive media and services and software and services; and 2) those mainly engaged in developing applications leveraging AI technologies, such as health-care and consumer-goods companies.

Source: MSCI ESG Research

Change the World - Subscribe Now

Biodiversity Investing Through the Voluntary Carbon Market

Investments in nature have become central to the voluntary carbon market, with a strong focus on biodiversity investing. Projects generating carbon credits face scrutiny, and high-integrity projects are essential. As of mid-2023, there were over 850 active nature-based projects, with another 2,100 in development. From 2012 to 2022, $16 billion was invested in these projects, and another $9 billion is projected by 2025. This trend highlights the importance of biodiversity investing, which supports climate goals and provides co-benefits like community support and conservation.

Investors must distinguish between high and low-integrity projects. High-quality projects demonstrate additionality, accurate quantification, permanence, and co-benefits, ensuring positive impacts for both climate and biodiversity.

Nature is becoming a much more investable prospect

Data has been obtained from three main sources: (1) a survey of market participants conducted during April and May 2023, (2) analysis of more than 400 public announcements of capital raises for low-carbon funds and (3) modeled investment for over 7,000 projects, both registered and in the development pipeline.

Data as of June 30, 2023. Source: MSCI Carbon Markets (formerly Trove Research)

A Changing Landscape for Sustainable Investing

MSCI’s Sustainability and Climate Trends to Watch 2024 outlines key themes shaping ESG investing. Extreme weather’s impact on workplaces necessitates innovative workforce management strategies. Managing AI’s effects on data privacy requires enhanced privacy provisions. Biodiversity investing through the voluntary carbon market is a growing industry, demanding careful evaluation of project integrity. As we enter 2024, understanding these evolving trends is crucial for navigating risks and opportunities in sustainable investing.

Conclusion

Navigating the evolving landscape of sustainability and climate investing in 2024 involves addressing extreme weather’s impact on workplaces, enhancing data privacy in the age of AI, and focusing on biodiversity investing in the voluntary carbon market. By understanding and integrating these trends, investors can effectively manage risks and seize opportunities in the sustainable investment arena.

Related Article: Private Equity’s Role in Delivering the SDGs

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn