Key Impact Points:

- Sector-Specific Performance: Utilities lead in EU Taxonomy alignment, while sectors like Chemicals and Energy face challenges in achieving high alignment levels.

- Assurance Gaps: Only 40% of companies in the report commissioned audits on their disclosures, with mandatory limited assurance to take effect in 2025 under CSRD.

- Expanded Reporting Scope: EU Taxonomy reporting now covers six environmental objectives, significantly increasing the scope and effort required.

Navigating EU Taxonomy Standards

KPMG’s latest report, Navigating EU Taxonomy: Progress and Pathways to Compliance, provides a detailed analysis of EU Taxonomy disclosures from 291 European entities, offering critical insights for U.S. companies preparing to comply with evolving global sustainability standards. The EU Taxonomy mandates companies to disclose revenue, capital, and operational expenditure linked to sustainable activities, a framework U.S. businesses will need to consider as they expand in international markets.

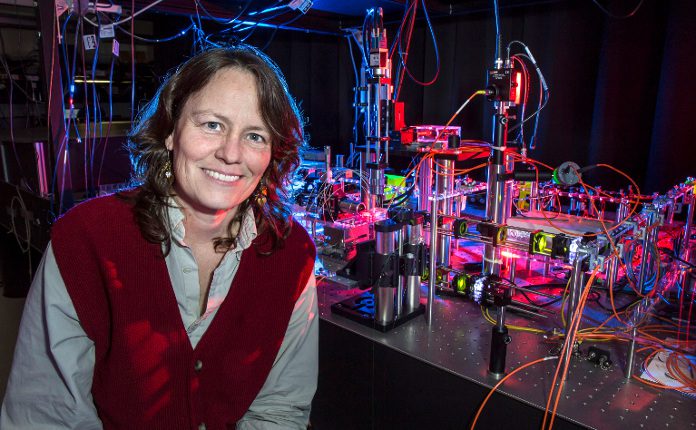

“As U.S. companies expand globally, understanding EU sustainability reporting requirements becomes crucial,” said Maura Hodge, KPMG US Sustainability Leader. “This report provides a roadmap for American businesses to prepare for mandatory EU Taxonomy reporting in 2025.”

Key Findings Relevant to U.S. Companies

The report identifies significant gaps in alignment and eligibility across sectors, with only 24% of analyzed companies obtaining limited assurance. Approximately 36% of companies did not report eligibility or alignment for newly added activities, indicating variability in taxonomy adoption. Insights include:

- Sector Disparities: The Utilities sector exhibits the highest alignment, while Real Estate reports the highest eligibility. In contrast, Chemicals and Energy sectors have lower alignment averages, with challenges in meeting EU Taxonomy’s technical criteria.

- Assurance Trends: Only 40% of companies have pursued limited assurance on taxonomy information, up slightly from last year. With the Corporate Sustainability Reporting Directive (CSRD) taking effect, limited assurance will soon become mandatory, driving further transparency.

“The EU Taxonomy’s impact extends beyond Europe,” Hodge added. “U.S. companies with European operations or aspirations must comply with these standards. Understanding EU companies’ results allows U.S. companies to determine where they want to be in the pack.”

Expanded Scope of EU Taxonomy

Since its introduction, EU Taxonomy reporting has progressively increased, covering all six environmental objectives. As of 2024, reporting extends beyond ‘Climate Change Mitigation’ and ‘Adaptation’ to include Water, Circular Economy, Pollution Control, and Biodiversity. The added objectives have required companies to invest additional effort in their disclosures, with companies now averaging a 43% eligibility rate across revenue, CapEx, and OpEx.

Future Considerations for U.S. Companies

The report underscores a growing need for transparency and verification in sustainability reporting, especially as the U.S. considers similar measures. By leveraging the insights from the EU Taxonomy disclosures, U.S. companies can proactively refine their sustainability practices in preparation for potential regulatory changes.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn