Key Points:

- Green banks are pivotal in channeling Inflation Reduction Act (IRA) funds, particularly through the $27 billion Greenhouse Gas Reduction Fund (GGRF).

- Green banks prioritize social equity in climate financing, targeting underserved communities for impactful clean energy investments.

- Partnerships with traditional banks, credit unions, and initiatives by America Is All In and CDP amplify the IRA’s climate finance impact.

As global climate challenges escalate, green banks are emerging as crucial players in the United States’ response, particularly under the Inflation Reduction Act (IRA). At Climate Week NYC 2024, CDP and America Is All In gathered green banks, financial institutions, and community development financial institutions (CDFIs) to explore the role of the IRA’s Greenhouse Gas Reduction Fund (GGRF), a $27 billion initiative launched in summer 2024. This fund aims to catalyze climate financing, especially within underserved communities, by mobilizing private capital and enabling impactful climate projects.

Green Banks’ Strategic Role in Climate Finance

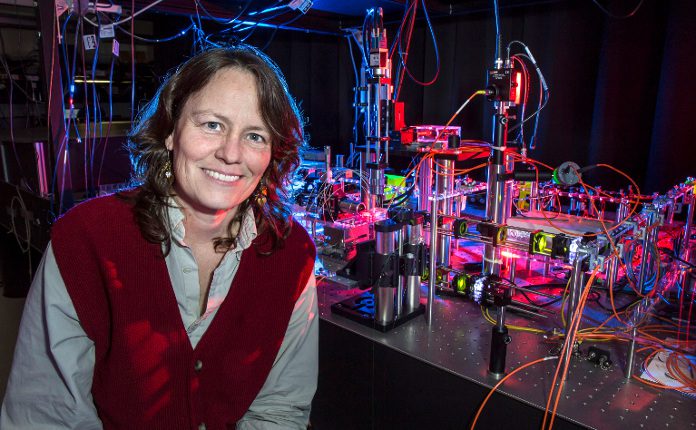

Green banks across the United States are driving localized climate initiatives, providing financing tools for clean energy projects such as residential solar and energy efficiency upgrades. Maryrose Myrtetus, Executive Director of the Philadelphia Green Capital Corporation, explained their place-based approach, which combines public, private, and philanthropic funding to expand clean energy investment. Highlighting green banks’ unique role, Bert Hunter of Connecticut Green Bank noted their success in financing projects that have prevented 11 million tonnes of CO₂ emissions since 2011. This impact underscores green banks’ potential to scale clean energy solutions under the IRA.

In a significant development, green banks nationwide have formed the U.S. Green Bank 50, a coalition of clean energy-focused public and nonprofit institutions generating over $10 billion in investments last year. This partnership aims to deepen collective efforts in addressing climate risks and accelerating the clean energy transition.

Advancing Social Equity through the IRA

The IRA prioritizes social equity, with green banks focusing on economically and environmentally disadvantaged communities. Chanell Scott Contreras, President of Michigan Saves, shared how their Bridge Financing program offers critical upfront capital for projects in solar, electric vehicle fleets, and geothermal systems, often beyond the reach of small businesses and community organizations. This model supports job creation and community empowerment, emphasizing climate finance as a tool for social equity.

Change the World - Subscribe Now

Traditional Banks as Amplifiers of Climate Funding

Traditional banks are also instrumental in maximizing the IRA’s impact. Emily Robichaux, Director of Climate Partnership Lending at Amalgamated Bank, discussed how green banks can de-risk climate projects, enabling larger banks to step in with co-financing. By supporting core “bedrock” loans, green banks build confidence, encouraging institutions like Amalgamated to deploy additional capital for climate projects.

Expanding Access through Credit Unions and CDFIs

Community development financial institutions (CDFIs) and credit unions play a vital role in green financing for underserved populations. Jesse Gerstin of Inclusiv outlined plans to distribute a $1.87 billion federal award across 300-400 credit unions, funding clean energy projects like solar and electrification in low-income areas. With significant demand for green training programs, these initiatives aim to build a skilled workforce to support the clean energy transition.

America Is All In and CDP’s Role in Strengthening Green Banks

America Is All In, representing a vast network of U.S. climate leaders, collaborates with green banks to provide training and optimize federal resource use. CDP, managing a global disclosure system, supports sustainable investment by providing data to over 700 financial institutions. According to CDP’s 2023 U.S. Infrastructure Snapshot, U.S. cities reported a $27 billion funding need in sectors like transportation and renewable energy. This identified need supports green banks by enhancing underwriting practices and attracting capital for high-impact projects.

Green banks, through strategic collaboration with financial institutions and community partners, are at the forefront of deploying IRA funds. Their work is essential in driving equitable and scalable climate finance solutions, making green banks a cornerstone of America’s climate finance landscape.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn