Key Impact Points:

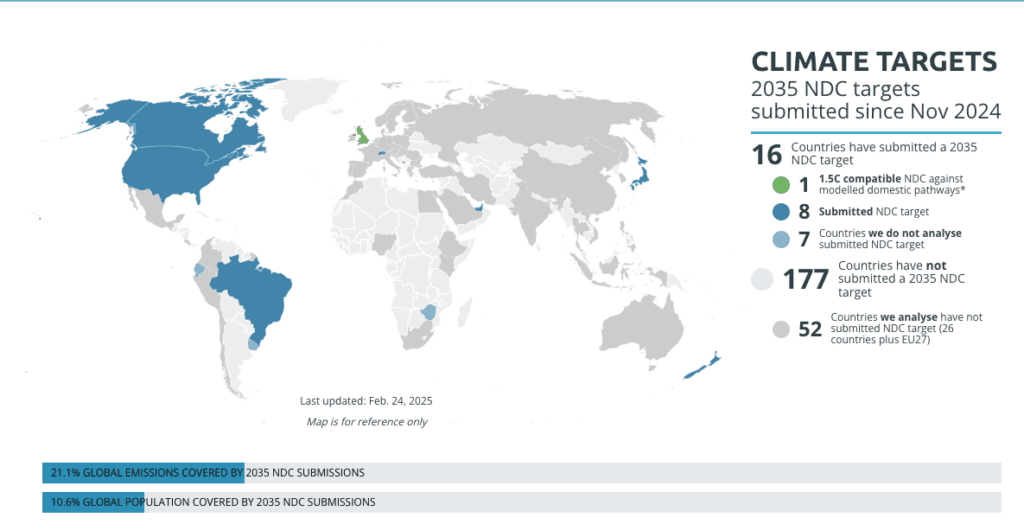

- Only 16 out of 193 countries have submitted their 2035 Nationally Determined Contributions (NDCs) since November 2024.

- The United Kingdom is the sole nation with a 1.5°C-compatible NDC aligned with modelled domestic pathways.

- These submissions cover 21.1% of global emissions and 10.6% of the world’s population.

As of early 2025, the Climate Action Tracker (CAT) reports that 16 countries have submitted their 2035 NDC targets. Among these, only the United Kingdom’s commitment aligns with the 1.5°C modelled domestic pathways. The remaining 179 countries, including major emitters like China, India, and the EU, have yet to submit updated targets. Notably, the current submissions account for just over a fifth of global emissions and a tenth of the global population.

Breakdown of Submissions

1.5°C Compatible NDC:

- United Kingdom: Submitted a target to cut emissions to 81% below 1990 levels by 2035, aligning with the 1.5°C modelled domestic pathways.

Submitted a 2035 NDC:

- Developed Countries: Brazil, Canada, Japan, New Zealand, Singapore, Switzerland, United Arab Emirates, United States.

- Other Nations: Andorra, Ecuador, Marshall Islands, Montenegro, Saint Lucia, Uruguay, Zimbabwe.

No 2035 NDC Submitted:

- Countries Analyzed by CAT: Australia, Chile, China, Colombia, Costa Rica, Egypt, Ethiopia, European Union, India, Indonesia, Iran, Kenya, Mexico, Morocco, Nigeria, Norway, Peru, Philippines, Russia, Saudi Arabia, South Africa, South Korea, Thailand, Türkiye, Vietnam.

Updates Before COP29

As of July 10, 2024, the Climate Action Tracker (CAT) reported that 69 countries had submitted updated Nationally Determined Contributions (NDCs) since 2022. However, only a small fraction of these updates strengthened climate targets, while the majority failed to enhance ambition or remained unchanged.

Key Findings from Pre-COP29 NDC Updates

- 69 Countries Submitted an Update

- 5 countries strengthened their NDC targets.

- 37 countries did not increase ambition, meaning their updates failed to contribute meaningfully to deeper emissions cuts.

- 27 countries were not analyzed in the update.

- 0 countries had updates pending analysis.

- 0 Countries Proposed a New Update

- No countries formally proposed a stronger NDC target ahead of COP29.

- No countries indicated a willingness to submit a more ambitious target.

- 126 Countries Have Not Updated Their Targets

Coverage of Updated NDCs

40.6% of the global population is represented within these updates.

28.4% of global emissions are covered by the updated NDC submissions.

Updates Before 2022

As of December 2021, the Climate Action Tracker (CAT) reported that 128 countries, including the EU, had submitted new Nationally Determined Contributions (NDCs). Compared to later updates before COP29, a significantly higher proportion of global emissions and population were covered by these earlier commitments. However, only a fraction of these NDCs represented stronger climate action, with some failing to enhance ambition.

Key Findings from Pre-2022 NDC Updates

- 128 Countries Submitted a New NDC Target

- 23 countries submitted stronger NDC targets, reflecting more ambitious climate goals.

- 12 countries did not increase ambition, meaning their updates did not contribute to deeper emissions cuts.

- 93 countries were not analyzed in this update.

- 1 Country Proposed a Stronger NDC Target

- Only one nation made an official proposal for a stronger NDC target.

- No countries signaled an intent to submit more ambitious targets.

- 36 Countries Had Not Updated Their Targets

Coverage of Updated NDCs (as of Dec 2021)

- 84.9% of global emissions were covered by updated NDC submissions.

- 74.0% of the global population was represented within these updates.

Importance of Updating NDCs

The Paris Agreement, adopted in 2015, recognized that initial national targets were insufficient to limit global warming to 1.5°C. Consequently, countries agreed to periodically update their NDCs to enhance ambition. The first Global Stocktake under the Paris Agreement, concluded at COP28 in 2023, reaffirmed the inadequacy of current commitments and urged all parties to submit revised NDCs aligned with the 1.5°C goal. These updated targets are crucial for driving global efforts to mitigate climate change effectively. (Source: climateactiontracker.org)

Conclusion

The slow progress on 2035 NDC updates highlights a concerning decline in climate ambition. While pre-2022 updates covered nearly 85% of global emissions, the latest round before COP29 saw a dramatic drop to just 28.4%. The number of countries strengthening their targets has also plummeted, with only 5 nations enhancing ambition before COP29, compared to 23 before 2022.

This backslide comes at a critical moment when scientific consensus warns of rapidly closing windows to limit warming to 1.5°C. Despite the urgency, major emitters—including China, India, and the EU—have yet to update their 2035 commitments, leaving a significant gap in global climate leadership.

With COP30 approaching, the world faces a pivotal choice: continue the trend of weak commitments or take decisive action to align with the Paris Agreement’s 1.5°C goal. The coming months will determine whether governments step up or allow climate inaction to derail progress on global emissions reduction.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn