Chris Killian, Eastman’s chief technology and sustainability officer, describes how integrating innovation strategy and sustainability can drive business growth and societal impact

A growing body of evidence across sectors and industries shows that a company’s efforts to achieve sustainability goals can help it outperform competitors, improve the bottom line, and drive growth. A case in point is the global chemicals and specialty materials company Eastman Chemical.

“We saw about a decade ago that sustainability could be a key component of our innovation-driven growth strategy,” says Chris Killian, chief technology and sustainability officer at Eastman.

In this conversation with Deloitte Consulting LLP principal Tom Aldred and Polina Markovich, a managing director in Deloitte Consulting LLP’s sustainability practice, Killian draws on Eastman’s experience executing on a circularity-focused business model and strategy to discuss how sustainability can generate business value.

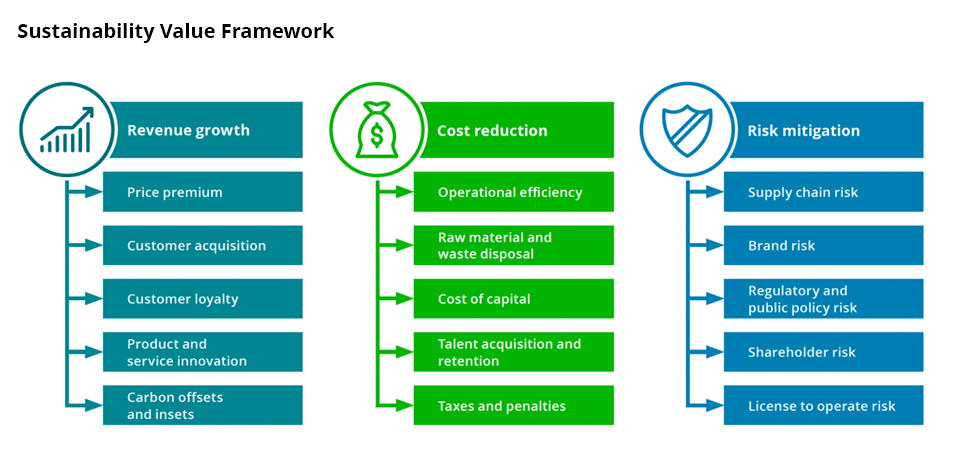

Polina Markovich: At Deloitte, we have shown that sustainability can drive revenue growth, cost reduction, and risk mitigation. What is Eastman’s approach to using sustainability to create business value?

Chris Killian: For Eastman, the business value of sustainability is mainly about revenue growth—it’s integral to our innovation-driven growth strategy because it can create behavior change in the marketplace. That’s an imperative if you’re going to be successful in launching a new disruptive product, or in our case, leveraging an existing product into a new materials application. Behavior change can be driven by consumer preference, by policy, by brand commitments, or it can be driven by sustainability trends, which is what we saw happening about 10 years ago.

That is why we integrated innovation with sustainability to drive our growth strategy, and that is reflected in my role leading technology innovation strategy and sustainability strategy. Our approach is to be on the lookout for market disruption caused by sustainability drivers that align with areas in which we have differentiated technology. We committed to connecting more than 90% of our R&D investment to a macro sustainability trend so that we’re developing new technologies that are more sustainable than incumbent technology.

Tom Aldred: What would be an example of how you leverage market disruptions caused by sustainability trends?

Killian: In the case of what we call our polyester recycling platform, we saw that many industries that use plastics in durable applications, such as appliances and reusable water bottles, were looking to include recycled content in their products and for ways to decrease emissions from their plastics supply chain, or Scope 3 emissions. The challenge there is that traditional mechanical recycling processes are only capable of recycling about 30% of all the PET plastic waste that is generated. For example, the recycling rate for the PET plastic widely used in plastic water and soft drink bottles is just about12%.

We developed a molecular solution that can recycle amounts approaching 100% of those hard-to-recycle polyester plastic waste materials by breaking it down into its chemical building blocks, while using over 50% less fossil resources than traditional processes. Converting plastic waste material back to basic chemical building blocks is very complex. There was significant technological development, piloting, and scale-up barriers that represented a challenge in bringing those materials to market. That all took significant R&D and capital investment, including a pilot plant and then hundreds of millions of dollars to build a facility in Kingsport, Tenn., for this new process. But the result is that we are now able to convert approximately 100,000 tons of waste plastic material in a single year into monomers for our specialty polyester materials that are used in durable applications such as food storage containers, small and large appliances, and reusable water bottles, among many other applications.

Both that materials platform and our cellulose ester biopolymer platform, for producing a cellulose-based compostable replacement for polystyrene packaging, are highly aligned with the three primary areas of sustainability that we focus on as a company: mainstreaming circularity, which for us is about repurposing carbon that’s already been extracted from the environment to make new materials; caring for society by reducing resource and environmental waste and eliminating materials of concern from the products of customers and brands we serve; and decarbonization. We innovate to use less energy in our processes, which has an economic benefit for us and a wider impact on society.

At a high level, that’s how we strategically think about sustainability and how the business and financial side of the organization is integrated into the innovation sustainability side.

Markovich: Were there any key metrics for leadership in evaluating the business case for investing in these innovations? Did the projects have to meet certain criteria?

Killian: The business case must be durable across macroeconomic, political, and social environments. There’s always an element of risk because you’re heading down an innovation path with a significant multi-year investment without clarity on what the macro environment will look like when your product is ready to go on the market. The payback on those types of investments tends to be multi-year, so the business case must be durable.

Aldred: From your perspective, what makes for a durable business case?

Killian: I would point to several criteria. First, you must have a technology that delivers a high-performing product for multiple markets and applications, it must address unmet customer needs, and there must be disruption across multiple markets.

Second, the product should have performance equal to or better than the incumbent in the market or application—because very few customers or consumers are willing to trade off product performance for the sake of sustainability. So, in our case, many of the brands we work with were accustomed to the mechanical recycling paradigm to make their products sustainable. We had to shift that paradigm to molecular recycling, which is differentiated because the recycled polymer we create is identical to the virgin fossil-based material. We had to demonstrate that we could achieve that level of performance with molecular recycling technology.

And third, the economics of that product must be competitive. A highly sustainable product that costs significantly more than the incumbent product is not likely to be universally adopted.

When you have sustainability value with performance value and the economics, that’s when the business case comes together and creates something good for consumers, society, and the business bottom line. Without that type of discipline and those principles, you likely don’t end up with a durable business case that survives across various macroeconomic, consumer behavior, and policy landscapes.

Aldred: How do you measure success with respect to your strategy and its three pillars? For example, with circularity, oftentimes there is a significant cost required to stand up the circular processes.

Killian: We employ different time horizons across our innovation portfolio, ranging in programs where you have conversion from idea to sales of around 12 months, all the way to programs that take three to five years, such as for the methanolysis scale-up, commercialization, and technology development.

Typically, those longer time horizon programs need to have a bigger potential payback because both the duration and the magnitude of the investment are larger.

Markovich: What would you say to leaders in the materials industry and beyond who are resistant to this disruption and not embracing the business and economic value of sustainability?

Killian: I think it’s a missed opportunity. Speaking of Eastman’s sector, we cannot independently solve issues around sustainability, whether that be waste, mitigation of climate change, or dealing with materials of concern, unless the chemicals and materials industry plays a central role. Companies that embrace sustainability disruption can innovate solutions that benefit their bottom line and society.

Beyond the private sector, there’s the broader economic opportunity of building out a circular economy. Public-private partnerships are a way to help achieve this because of the capital intensity needed to create a supply chain and the infrastructure to support a circular economy. For instance, the recycling business could be best served as a regional business, as the cost and emissions of shipping waste plastic to be recycled around the globe could be prohibitive. Building a materials waste recycling supply chain and infrastructure in the United States could mean more American businesses and more American jobs.

—by Andy Marks, editor, Executive Perspectives in The Wall Street Journal, Deloitte Services LP

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn