Key Impact Points:

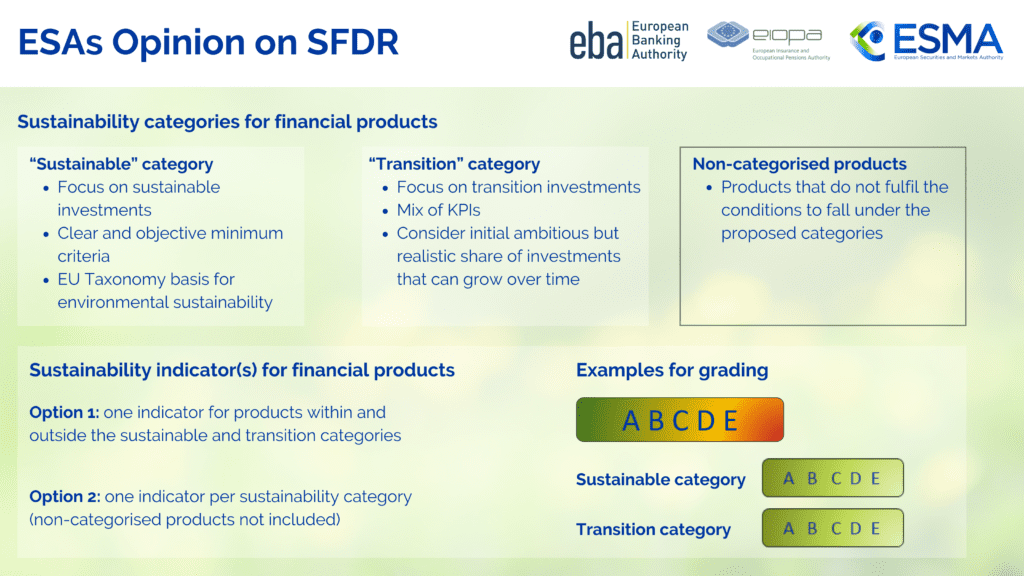

- New Product Categories: Introduction of “sustainable” and “transition” categories to improve clarity and reduce greenwashing.

- Sustainability Indicator: A proposed grading scale for financial products’ sustainability profiles.

- Enhanced Disclosures: Stricter rules for products to ensure transparency and prevent misleading marketing.

The three European Supervisory Authorities (EBA, EIOPA, and ESMA – ESAs) have published a joint Opinion on assessing the Sustainable Finance Disclosure Regulation (SFDR). The ESAs advocate for a coherent sustainable finance framework that supports both the green transition and enhanced consumer protection, learning from the current functioning of the Sustainable Finance Disclosure Regulation.

Introduction of Simple Categories

To simplify and clarify financial product offerings, the ESAs propose two voluntary categories: “sustainable” and “transition.” These categories are designed to help consumers understand the purpose of financial products, ensuring they meet clear objectives and criteria to mitigate greenwashing risks.

Sustainability Indicator

The ESAs recommend introducing a sustainability indicator to grade financial products, such as investment funds, life insurance, and pension products. This indicator would help consumers easily comprehend the sustainability profile of these products.

Change the World - Subscribe Now

Enhanced Disclosures

The Opinion also addresses the need for appropriate disclosures for products outside the new categories to reduce greenwashing. Improvements to the definition of sustainable investments, simplification of disclosure presentations, and technical suggestions on the scope of Sustainable Finance Disclosure Regulation are also covered. The ESAs emphasize the importance of consumer testing before implementing any policy proposals, such as the categorization system or sustainability indicator.

Background and Future Support

The ESAs issued this Opinion independently, within the context of the European Commission’s comprehensive review of the SFDR framework, including SFDR regulation and Delegated Regulation. The ESAs are prepared to assist the European Commission in future policy considerations regarding any SFDR framework review.

Quotes from Key Leaders:

- ESAs Statement: “The introduction of regulatory product categories will help address greenwashing problems and generate clarity for investors, particularly retail investors.”

The proposed updates to the Sustainable Finance Disclosure Regulation aim to create a more transparent and trustworthy sustainable finance landscape, protecting consumers and supporting the green transition.

Related Article: EU Council Advances Green Claims Directive to Combat Greenwashing

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn