Key Impact Points:

- European electrical equipment companies outperform global competitors in managing ESG risks, especially in product governance and carbon management.

- The EU’s renewable energy target of 42.5% by 2030 could shift auction awards toward European firms through new ESG-based criteria.

- EC-backed policies like the Net-Zero Industry Act and Wind Power Action Plan aim to integrate sustainability in renewable energy auctions, potentially favoring European players.

Strong ESG Management in Europe

European electrical equipment companies lead in managing product governance and carbon-related risks compared to global peers, according to Morningstar Sustainalytics. They surpass Asia-Pacific firms in adopting quality management systems, environmental sustainability, and end-of-life stewardship programs for products.

For instance, European firms like Vestas and Nordex demonstrate lower ESG Risk Ratings, positioning them to gain from upcoming EU renewable energy auctions emphasizing non-price criteria.

“There is a much higher percentage of European companies with strong management compared with companies in other regions,” highlights Morningstar Sustainalytics.

The Push for ESG-Based Auction Criteria

The European Commission (EC) is encouraging member states to adopt non-price criteria in renewable energy auctions. These include sustainability and resilience metrics weighted at 15–30%, as mandated by the Net-Zero Industry Act. Current adopters like Germany, France, and the Netherlands are setting benchmarks for integrating ESG factors into wind and solar projects.

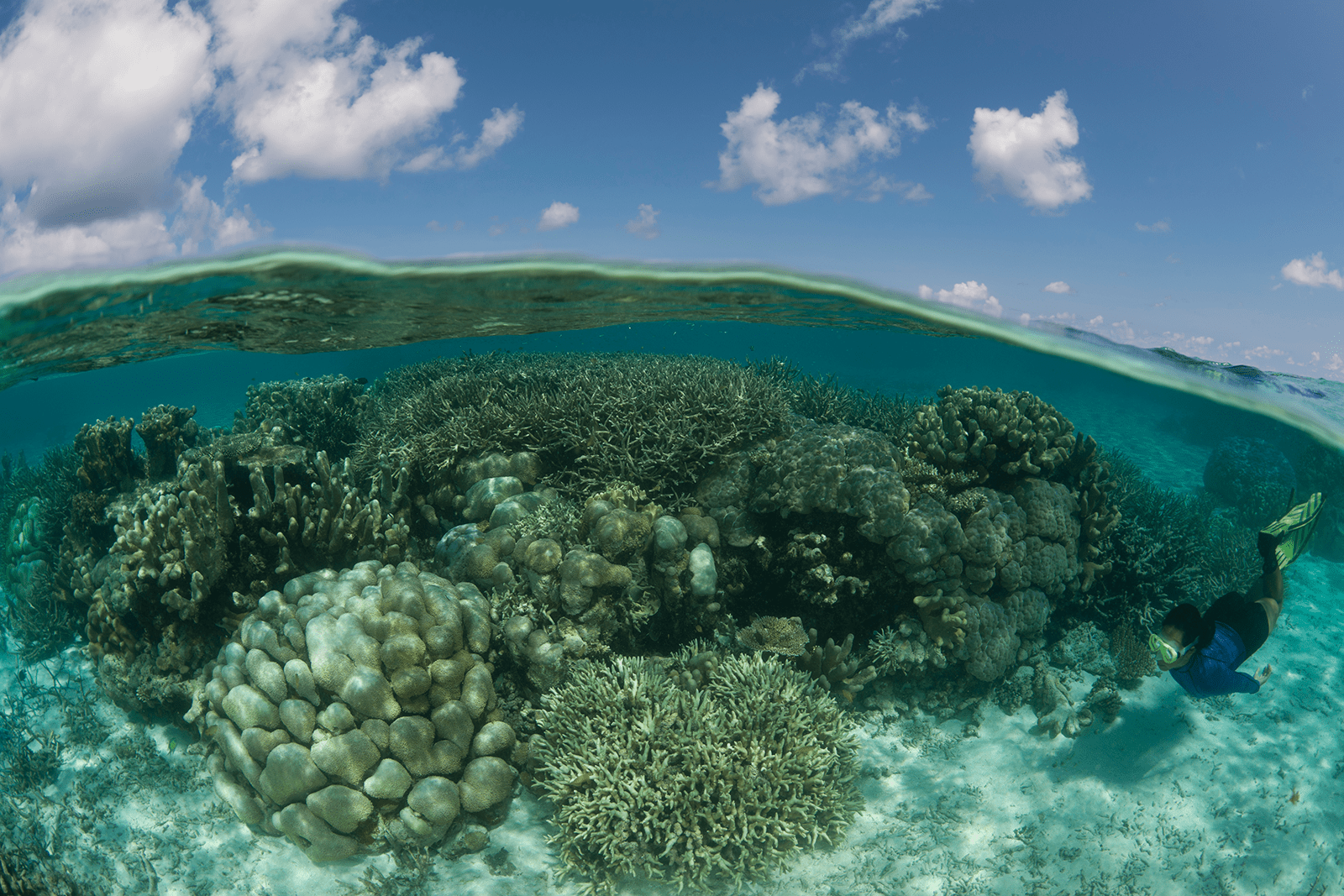

“Utilities that win an auction may be subject to ecological sustainability criteria for the project site,” notes Sustainalytics.

Renewable Energy as a Strategic Asset

The EU’s €140 billion annual investment in solar and wind capacities until 2030 isn’t just about decarbonization. Russia’s invasion of Ukraine has underscored the need for energy sovereignty, driving the urgency of securing local renewable energy supply chains.

At the heart of this push, policies like the Wind Power Action Plan and European Wind Charter signal Europe’s commitment to sustainability. By March 2025, the EC will further refine the sustainability criteria used in auctions, shaping the competitive landscape.

“Introducing award criteria could affect solar and wind energy companies’ ecosystem, including electrical equipment companies,” Sustainalytics emphasized.

Future Challenges and Opportunities

The move towards ESG-based criteria in auctions could favor European firms. However, the adoption rate may fluctuate with political shifts across member states, potentially stalling momentum. Sustainalytics underscores that clearer criteria will enable better assessments and comparisons in the future.

European firms remain well-placed to lead, ensuring the continent’s renewable energy transition aligns with its sustainability and sovereignty goals.

Related Article: Morningstar: The 10 Largest Funds Aligned to Sustainable Development Goals