Key Impact Points:

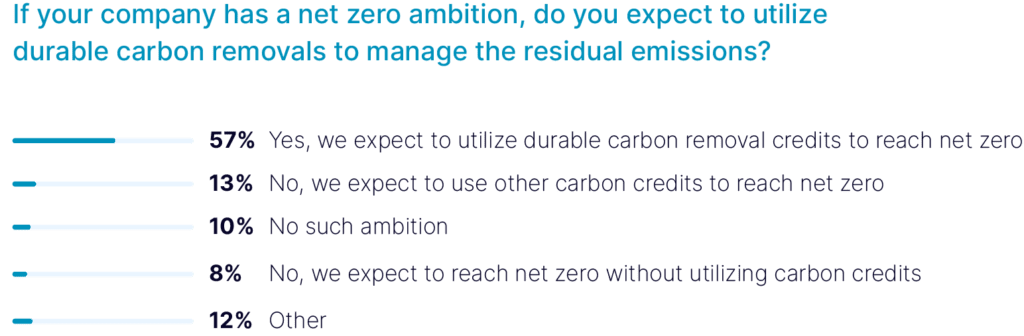

- 57% of companies plan to invest in nature-based and technology-based carbon removal solutions to reach net zero.

- 72% of companies feel pressured by regulatory frameworks like the SEC’s Climate Disclosure Rules and California’s AB-1305.

- 80% of corporate buyers seek further education on carbon removal credits and strategies.

A new survey by Nasdaq offers crucial insights into how companies are adapting their carbon credit strategies to align with net zero goals. The 2024 Global Net Zero Pulse Report highlights shifts in corporate buyer preferences, regulatory challenges, and the growing demand for education on carbon removal credits. Read the full report here.

Carbon Credit Strategy Alignment

According to the report, 57% of companies expect to use nature-based and technology-based carbon removal solutions to neutralize their residual emissions. This finding underscores the increasing reliance on carbon dioxide removal (CDR) as a crucial tool within the corporate net zero strategy. As the market evolves, fewer than 10% of companies expect to reach net zero without using any carbon credits.

Change the World - Subscribe Now

Regulatory Pressures Mounting

With increasing scrutiny around greenwashing, companies face mounting pressure from regulatory frameworks. 72% of respondents report feeling the effects of policies like the SEC’s Climate Disclosure Rules and California’s AB-1305. This evolving regulatory landscape plays a growing role in shaping corporate carbon credit procurement strategies.

Education Gaps in Carbon Removal

The report also reveals significant knowledge gaps in carbon credit education. While companies are familiar with carbon removal pathways like reforestation (83%) and direct air capture (76%), ocean-based CDR pathways are far less understood. 80% of corporate buyers expressed interest in further education on carbon removal credits, signaling a clear need for additional resources to support informed decision-making.

Looking Ahead

As more companies align their strategies with net zero targets, the importance of durable CDR credits is expected to rise. Nasdaq’s report highlights the critical need for continued education and regulatory clarity to scale these efforts effectively.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn