The 2025 IMF Annual Meetings in Washington ended with a stark message: the global economy’s resilience is wearing thin. Behind the handshakes and optimism of finance ministers and central bankers, the International Monetary Fund’s latest World Economic Outlook delivered a sobering verdict—growth is slowing, debt is mounting, and the fragile calm masking deeper risks may not last through next year.

In a week that brought together more than 10,000 delegates from 190 countries, IMF Managing Director Kristalina Georgieva called for “resilience in a world of uncertainty.” The Fund’s flagship report, Global Economy in Flux, Prospects Remain Dim, revealed that global growth will likely reach 3.2 percent in 2025 before slipping to 3.1 percent in 2026, with the outlook clouded by tariffs, protectionism, and fading fiscal capacity.

A World Divided Between Momentum and Malaise

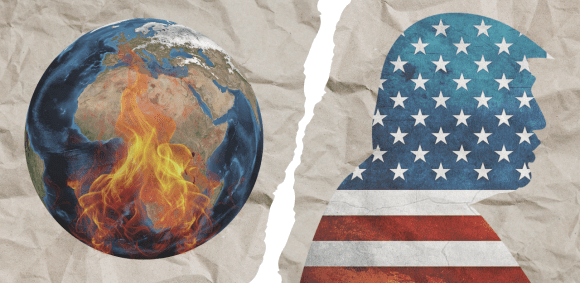

The United States and China remain at the center of gravity—and tension. Washington’s tariffs, now near 19 percent, have distorted global trade while driving up costs at home. Beijing, meanwhile, faces weakening demand and the lingering drag of a deflated property sector. Europe’s recovery is uneven, buoyed by fiscal expansion in Germany but strained by aging populations and debt pressures.

Delegates left Washington with a shared sense that the global economy is now defined more by divergence than coordination. One official put it bluntly: “Resilience is no longer strength—it’s inertia.”

Technology Boom, Policy Bust

Artificial intelligence dominated the meeting’s side events, with IMF economists drawing parallels to the dot-com bubble of the late 1990s. AI’s promise to boost productivity is undeniable, but its speculative momentum has inflated markets and widened inequality. If expectations fail to deliver, the Fund warned, a sudden repricing could trigger a chain reaction across asset markets and global finance.

Meanwhile, central banks face growing political interference, threatening their credibility just as inflation pressures persist. Georgieva’s closing plea was for “policy independence without paralysis”—a call that resonated in a year when trust in technocratic institutions has been tested like never before.

Debt and the Decline of Fiscal Space

Perhaps the most urgent message from the week’s proceedings concerned public debt. Advanced economies are spending more on defense and industrial policy, while developing countries are struggling under tighter financial conditions and shrinking aid flows. The Fund noted that official development assistance fell nine percent last year and is expected to decline again, leaving low-income countries exposed to social unrest and stalled investment.

A New Multilateral Reality

Despite the grim data, the meetings underscored a growing appetite for pragmatic cooperation. Delegates pointed to a shift toward “coalitions of the willing” on debt restructuring, AI governance, and sustainable finance. Still, the IMF cautioned that fragmented initiatives cannot replace coordinated global policy. Without renewed trust in multilateralism, it warned, the cracks in today’s global order could widen into crises tomorrow.

Related Content: UNEP Launches $100 Million Programme to Accelerate Climate and Nature Action

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn