Key Impact Points:

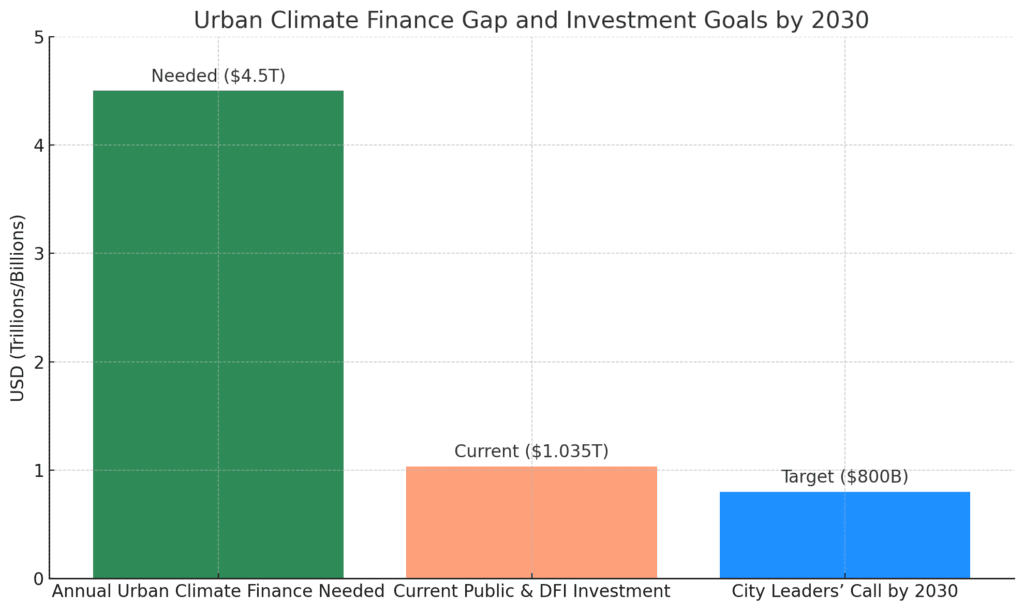

- Multilateral Development Banks reaffirm commitment to scale urban climate finance, aiming to help close the $4.5 trillion annual urban investment gap.

- City leaders call for $800 billion in public urban climate finance annually by 2030—current funding meets only 23% of that goal.

- MDBs signal stronger partnerships with local governments to accelerate adaptation and infrastructure projects, especially in the Global South.

Multilateral Development Banks advance plans to scale investment in cities

Multilateral Development Banks (MDBs) met for the third roundtable in a series of high-level discussions launched in 2023, focused on unlocking sustainable urban investment. The session, titled “Scaling Sustainable Investment in Cities: The Role of MDBs,” was co-convened by C40 Cities, the Global Covenant of Mayors for Climate and Energy (GCoM), and Bloomberg Philanthropies.

The meeting marks a pivotal moment in efforts to close the $4.5 trillion urban climate finance gap projected through 2030.

Source: SDG News, JP Morgan

City leaders demand tangible action

In March 2024, more than 40 mayors from 30+ countries signed an open letter urging MDBs to prioritize urban climate finance. They called for tailored urban climate programs, project support, and greater alignment with city-level strategies.

Dr. Nasiphi Moya, Executive Mayor of Tshwane, South Africa, emphasized:

“We deeply appreciate the bank’s positive response to our call for funding. This demonstrates that MDBs are not only listening, but are truly committed to supporting the work cities are doing… Now is the time to shift from talk to tangible implementation.”

MDBs respond with commitments

In response, Multilateral Development Banks pledged stronger collaboration, including subnational lending, derisking tools to attract private capital, and a sharper focus on adaptation.

Juan Pablo Bonilla of the Inter-American Development Bank stated:

“The IDB is committed to scaling financial investments for urban infrastructure… and reducing the finance gap for better urban futures in Latin America and the Caribbean.”

Ambroise Fayolle, Vice President of the European Investment Bank, added:

“We are committed to working with cities and mayors… to finance climate action which will reinforce stability and prosperity for our communities.”

Aligning with national ambitions and CHAMP

The discussion also supports CHAMP (Coalition for High Ambition Multi-level Partnerships), launched at COP28 to boost subnational climate action. With 75+ national governments onboard, CHAMP aligns local climate action with national strategies like NDCs and LT-LEDS.

Andy Deacon, GCoM Co-Managing Director, said:

“These discussions represent a significant step forward… to strengthen public leadership collaboration between national governments, Multilateral Development Banks, and local leaders.”

Raising the stakes ahead of COP30

At the 2024 U20 Summit in Rio, mayors called for at least $800 billion in annual urban climate finance by 2030. Current funding—public and DFI combined—reaches just 23% of that target.

Andrea Fernández, Managing Director at C40, noted:

“Public investment made by Multilateral Development Banks’ is essential… helping cities unlock and access both public and private funding that contributes to reaching the total of $4.5 trillion cities need annually.”

Final message to global financial institutions

Anyang’ Nyong’o, Governor of Kisumu, Kenya, delivered a clear call to MDBs and national governments:

“Local governments can no longer be treated as secondary actors… When MDBs invest in cities, they’re not just funding infrastructure – they’re investing in more resilient, inclusive, and empowered communities.”

MDBs, mayors, and global partners will reconvene to demonstrate measurable progress ahead of COP30.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn