The ocean economy—sometimes called the blue economy—is vast, undervalued, and under threat. The World Wildlife Fund (WWF) estimates the global ocean’s asset value at $24.2 trillion, though that figure is likely conservative, with ecosystem services like carbon sequestration and coastal protection notoriously difficult to quantify.

But this liquid goldmine faces mounting risks: over $8.4 trillion of that ocean value is at stake if business-as-usual continues. That’s where blue finance steps in.

Blue Finance: Defined

Blue finance refers to investment strategies and financial instruments—like blue bonds—that support ocean-related sustainability goals, from coral reef restoration to sustainable fisheries and marine protected areas. It’s the ocean-focused cousin of green finance, and it’s just getting started.

As of early 2025, blue bond issuances total just $6.8 billion, according to Sustainable Fitch—a fraction of the $443 billion green bond market in 2022, per S&P. But momentum is building fast.

Leading Players in the Blue Bond Movement

Several key actors are shaping this emerging market:

- The Nature Conservancy (TNC) – a pivotal force behind blue sovereign bonds in Seychelles, Belize, Barbados, and Gabon, often using a “debt-for-nature swap” model.

- International Finance Corporation (IFC) – partnered with BDO Unibank for a $100M private blue bond in 2022.

- Asian Development Bank (ADB) – issued its first blue bond in 2021 to support ocean health across Asia-Pacific.

- Export-Import Bank of Korea – launched a $1 billion, 10-year blue bond.

- Ørsted – issued a €100 million bond in 2023 to invest in offshore biodiversity and sustainable shipping—the largest blue bond to date by a private company.

Case Study: Why Panama Matters

Panama—host of Latin America and Caribbean Climate Week 2025—is positioning itself as a key player in the blue finance landscape. With both Pacific and Caribbean coastlines, the country is uniquely suited to pilot marine conservation and sustainable shipping projects backed by blue financing.

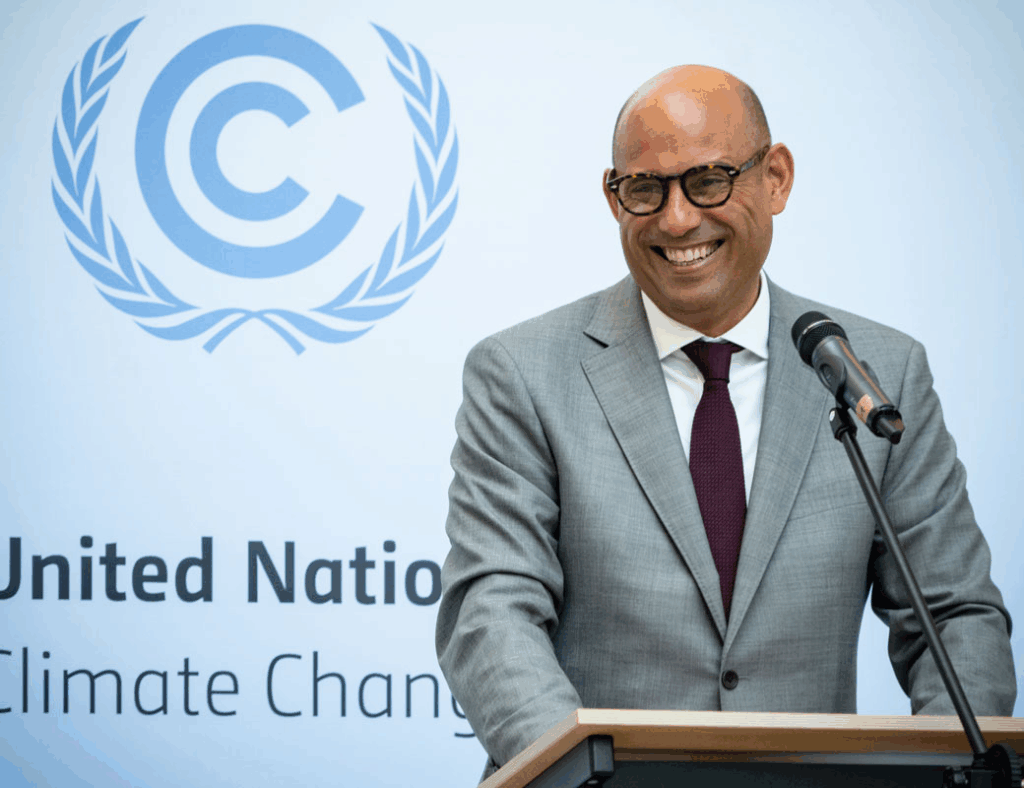

Simon Stiell, UN Climate Change Executive Secretary, spotlighted Panama’s role at Climate Week:

“Clear and strong climate policies are an antidote to economic uncertainty. Climate policy can help get trade flowing and economies growing.”

Panama’s leadership could help unlock scalable blue finance across the region—especially as countries prepare their next round of Nationally Determined Contributions (NDCs).

What’s Next: A Market Ready to Surge

Blue bonds are where green bonds were a decade ago. As awareness grows and new frameworks emerge—led by groups like the UN Global Compact, Ocean Risk and Resilience Action Alliance (ORRAA), and UNEP FI—the potential for growth is enormous.

And unlike carbon markets or climate tech, blue finance is still a wide-open frontier. The blue loan market is small, leaving a gap for innovation and impact by financial institutions, asset managers, and governments looking for investable, ocean-positive solutions

Related Article: The Business Case for a Sustainable Blue Economy

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn