HSBC Survey Reveals Waning Global Investor Interest in ESG

Key Points:

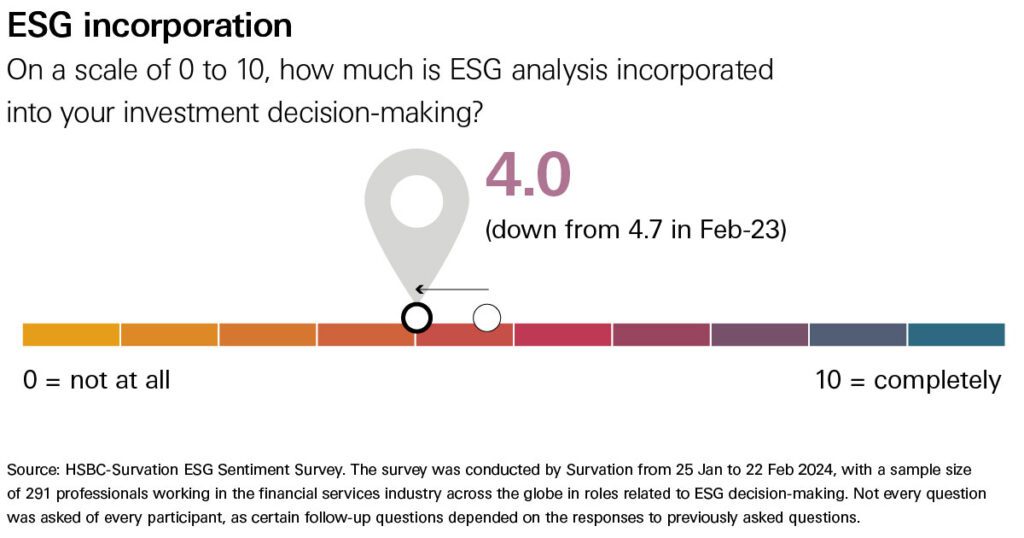

- Stalled Interest: Investor interest in ESG (Environmental, Social, and Governance) factors is stalling as fund managers shift focus to political and economic challenges, according to an HSBC survey.

- Regulatory and Performance Concerns: A lack of uniform ESG regulations and poor performance of certain ESG investments, like solar and wind stocks, contribute to waning enthusiasm.

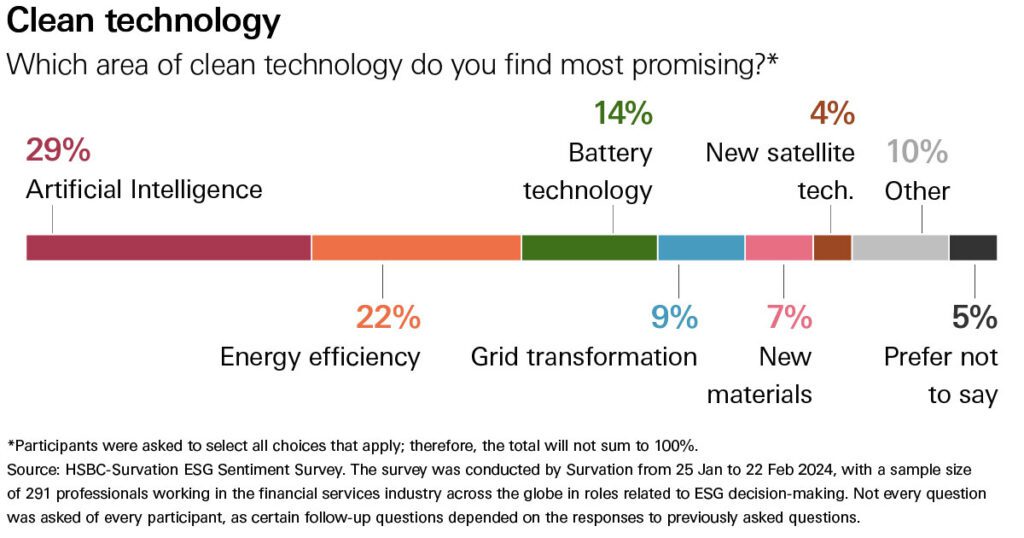

- Emerging Technologies: AI is viewed as a transformative tool, with many investors exploring its potential to enhance ESG analysis and monitoring.

Investor interest in Environmental, Social, and Governance (ESG) factors is showing signs of stalling as fund managers increasingly prioritize the challenging political and economic climate, according to a survey published by HSBC Holdings Plc. Analysts led by Wai-Shin Chan, HSBC’s head of ESG research, noted, “Global events continue to distract from long-term sustainability challenges.”

Survey Insights

The HSBC survey, conducted against the backdrop of continued anti-ESG sentiment in the US and geopolitical issues, captures the views of 291 respondents from 280 institutions representing $8.9 trillion in assets under management (AUM). It reveals weakened motivations for monitoring ESG risks “across the board.” Despite this, there is still evidence that “sustainability remains partly as an objective across many funds.”

Regional Differences and Evolution

While ESG is not trending as much, declines in sentiment are not universal across regions and asset classes. There are still sizable proportions of respondents who intend to increase ESG incorporation. HSBC analysts believe that ESG is undergoing an evolution, leading to potentially more robust frameworks and strategies in the future. “With fewer in the US explicitly talking about ESG, we see the rise of thematic investing as a compromise,” they observed.

Challenges in ESG Adoption

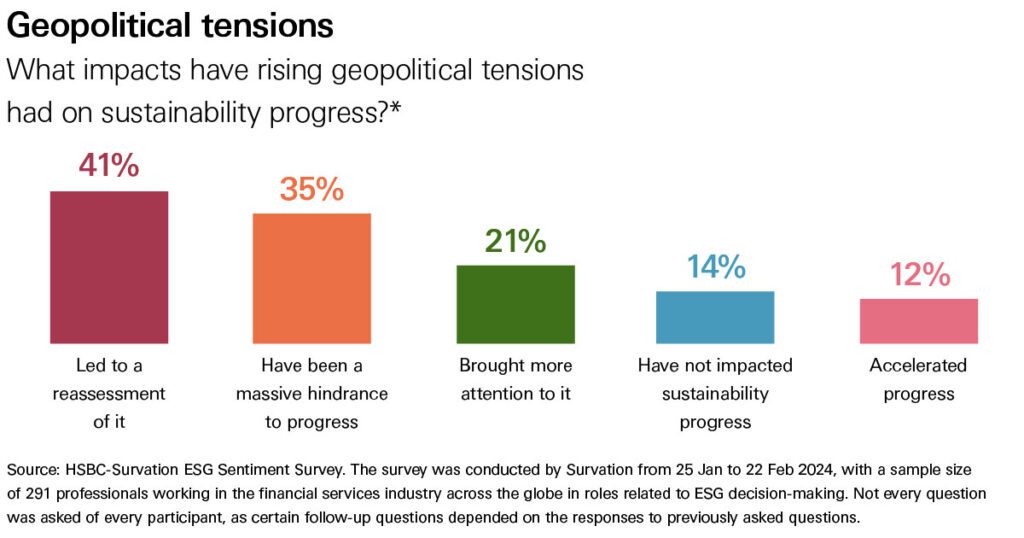

Geopolitics and Political Abstraction: Investors are spending more time focusing on geopolitical risks, leaving less room for sustainability considerations. In the US, anti-ESG sentiment has widened its influence, affecting membership in sustainable investing organizations and the incorporation of ESG into investment decisions. However, other respondents are planning for more ESG integration, stricter standards, and regulatory-driven ESG initiatives. “It is difficult to prioritize long-term sustainability in the short term. Time is limited and other issues are more urgent,” the HSBC analysts stated.

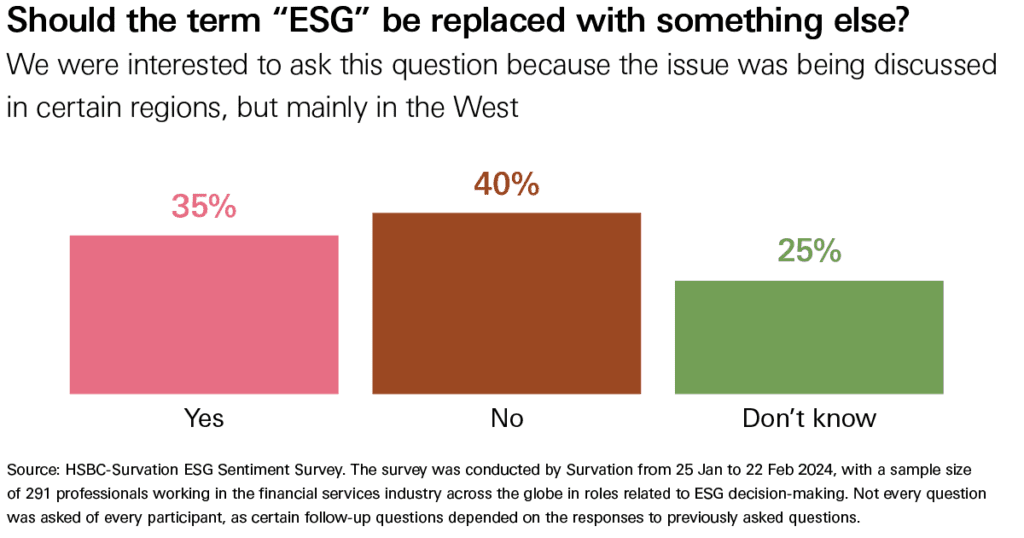

Nuanced Calibration: Over a third of respondents suggested replacing the term “ESG,” but more thought it should not be replaced. There is no clear alternative besides Responsible/Sustainable Investing, which is not new.

Emerging Technologies and ESG

Artificial Intelligence: The survey highlighted AI as a key transformative technology, with investors contemplating its use to monitor, analyze, or summarize sustainability issues. AI is seen as having the greatest potential to transform portfolios, ahead of technologies like batteries and energy efficiency measures.

Strategic Shifts

Major asset managers like BlackRock Inc., Deutsche Bank AG’s DWS Group, and Invesco Ltd. are reducing their ESG fund launches, as reported by Morningstar Direct. Additionally, redemptions from ESG funds continued in the US last quarter, though at a slightly slower pace.

As the ESG label struggles to gain traction, investment managers are increasingly adopting elements of the strategy under alternative names. Investment managers who incorporate ESG into their strategies primarily do so to attract capital rather than due to regulatory pressures. Notably, many highlighted water-related concerns and biodiversity as underappreciated risks. Social issues, such as freedom of speech and human rights, are also gaining attention.

Looking Ahead

Despite current challenges, there is room for optimism. Many investors are looking to advance their ESG analysis, incorporating broader issues and seeking more reasons to integrate ESG into their strategies. As one HSBC analyst concluded, “It has been and will be an interesting year when it comes to world events, and sustainability issues may struggle to compete for attention.” However, the evolving landscape of ESG presents opportunities for investors to innovate and adapt.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn