Key Impact Points:

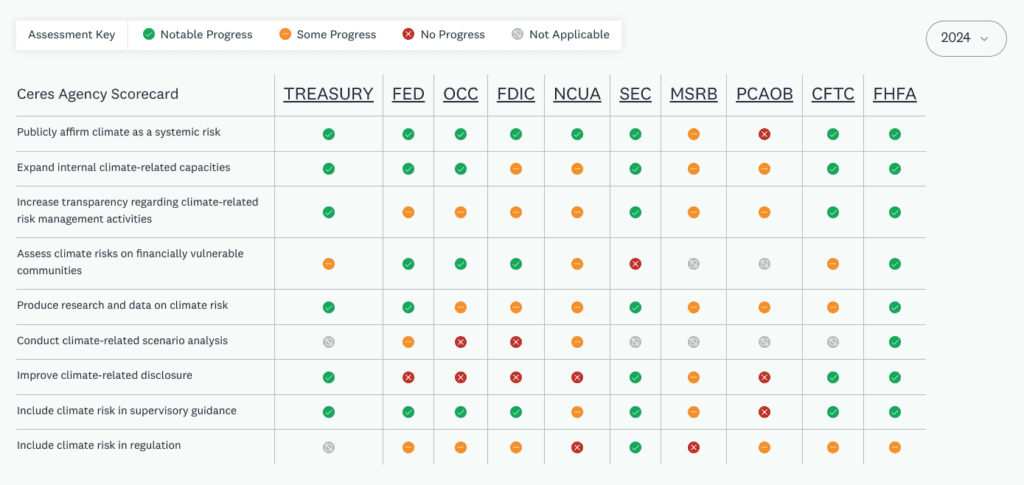

- 10 Federal Agencies Assessed: The 2024 Climate Risk Scorecard evaluates progress made by the Federal Reserve, SEC, FDIC, and seven other U.S. financial regulators in addressing climate-related financial risks.

- Over 100 Public Actions Reviewed: The report covers initiatives undertaken between July 2023 and November 2024, focusing on systemic financial risks from climate change.

- Annual Progress Monitored: Successive scorecards highlight steady advancements, with prior assessments in 2021, 2022, and 2023 revealing a consistent trajectory of improvement.

The Climate Risk Scorecard 2024: A Snapshot

The Ceres Accelerator for Sustainable Capital Markets unveiled its latest Climate Risk Scorecard, providing a comprehensive evaluation of how 10 federal financial agencies are tackling the systemic financial risks posed by climate change. These agencies include the Federal Reserve Bank, SEC, FDIC, and others.

Tracking Annual Progress

Since its inaugural edition in 2021, the Climate Risk Scorecard has been a barometer for regulatory action on climate risks. Initial findings revealed significant gaps in regulatory preparedness, while the 2022 Scorecard marked a shift with notable progress. The 2023 iteration reported over 100 public actions addressing climate-related financial risks between July 2022 and June 2023.

Change the World - Subscribe Now

For 2024, the report examines actions taken from July 2023 to November 2024, highlighting key regulatory milestones aimed at safeguarding U.S. financial systems, institutions, and communities.

Federal Agencies in the Spotlight

The Scorecard reviews efforts by 10 major agencies, including:

- The Federal Reserve Bank: Analyzing climate-related risks to financial stability.

- The SEC: Addressing climate disclosure requirements for public companies.

- The FDIC: Ensuring the resilience of insured institutions to climate risks.

“The Scorecard continues to show progress, but the work is far from over. Regulators must act swiftly to fully address climate-related financial risks,”

The 2024 Climate Risk Scorecard underscores the ongoing need for robust regulatory action to mitigate climate-related financial risks. It serves as a critical tool for stakeholders monitoring the intersection of climate and financial regulation.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn