Key Impact Points:

- Green Impact Exchange adds cybersecurity, ESG, and market governance experts to advance its sustainable finance mission.

- Appointments include leaders from the U.S. military, Franklin Templeton, ESG Book, Nigerian Exchange Group, and Kellogg Group.

- The expansion follows the SEC’s approval of GIX as the first U.S. national stock exchange focused on sustainability.

Green Impact Exchange Appoints Five New Board Members to Lead U.S. Sustainability-Focused Stock Market

The Green Impact Exchange (GIX), the first U.S. stock exchange dedicated to the $50 trillion sustainability economy, has appointed five new board members across its parent company and the exchange board. The additions bring deep expertise in information security, ESG strategy, market governance, and capital formation from both public and private sectors.

“These appointments represent a meaningful expansion of our board leadership and reinforce our mission to build a trusted, globally relevant exchange,” said Dan Labovitz, Chairman of the Board and CEO. “Their experience in innovation, financial governance, and sustainability will be instrumental in the advancement of sustainable finance and helping companies raise capital for their sustainable transitions.”

GIX’s New Leadership

The board will now include Kirk Kellogg, who will represent Green Impact Exchange (GIX)’s parent company, and four new independent directors:

- General William (Bill) Bender (Ret.) is a retired three-star general and former CIO of the U.S. Air Force, where he oversaw a $17 billion IT spend and a 54,000-person workforce. He pioneered major modernization initiatives including the Department of Defense’s first Chief Innovation Officer role, the Air Force Innovation Unit, and USAF’s Cloud First strategy.

- James Andrus brings extensive corporate governance and sustainability experience from roles including VP of Public Policy and VP of Sustainability for Global Markets at Franklin Templeton, and interim Managing Investment Director for Board Governance and Sustainability at CalPERS. He chairs the SEC’s Investor as Purchaser Subcommittee and advises the PCAOB, IFRS, and FASAC. “His career exemplifies a deep commitment to public service, investor protection, policy development, and collaborative leadership across sectors.”

- Maria Mähl is a Partner at ESG Book and former Partner at Arabesque. She has over 15 years of experience across sustainable finance, ESG data, carbon markets, and AI. Her previous roles include work at Volvo Group, Capgemini, the Clinton Global Initiative, UN, IIED, and blockchain firm Demia.

- Oscar N. Onyema, OON is a capital markets executive who transformed the Nigerian Stock Exchange and led the NGX Group public. With over 15 years of board leadership, he has chaired market infrastructure institutions and now serves as Chair of the GIX Board Regulatory Oversight Committee.

- Kirk Kellogg, founder of Kellogg Group LLC, brings experience from NYSE and AMEX member firms. He also serves on the boards of IAT Insurance Group, St. Lawrence University, the U.S. Ski & Snowboard Foundation, and is a former president of The Bond Club of New York.

SEC Approval Reinforces GIX’s Mission

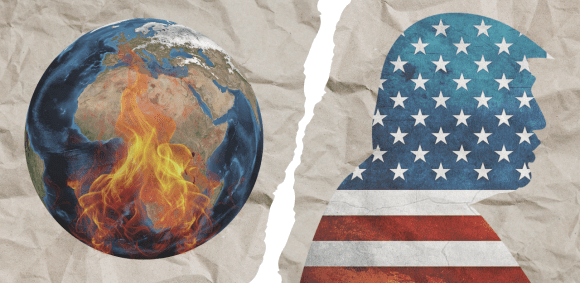

These board appointments follow a landmark decision from the U.S. Securities and Exchange Commission, which approved Green Impact Exchange as a national securities exchange earlier this month. The approval cements GIX’s position as the first U.S. stock exchange dedicated exclusively to companies committed to sustainability.

“Today’s approval order is an important step forward for sustainability-minded investors and companies,” said Green Impact Exchange CEO and Founder Dan Labovitz.

Raising the Bar for ESG Disclosure

Green Impact Exchange will allow dual listings for companies already on national exchanges—provided they meet its strict Green Governance Standards. These standards focus on transparency, accountability, and enforceable sustainability commitments.

“Climate risk is business risk. It’s that simple. U.S. investors and companies are continuing to pursue sustainability because it makes financial and competitive sense,” said Green Impact Exchange President and co-founder Charles Dolan. “Public markets like GIX have a pivotal role to play in connecting sustainable investors with companies that understand that.”

GIX is designed to combat greenwashing by elevating listing requirements, ensuring that sustainability disclosures are both auditable and credible.

Follow SDG News on LinkedIn

Follow SDG News on LinkedIn